The market capitalization of the cryptocurrency is actually stuck near the level of $955 billion. Even despite the increase in bullish signals, there are no significant changes in the price movement of the entire market.

Why is the crypto market worth it?

The main reason for the lack of significant price movement is the DXY index. The indicator peaked at 114, after which it began to decline. However, the corrective movement has not yet passed into the phase of a full-fledged downward trend. And this stops the growth of capitalization of high-risk assets.

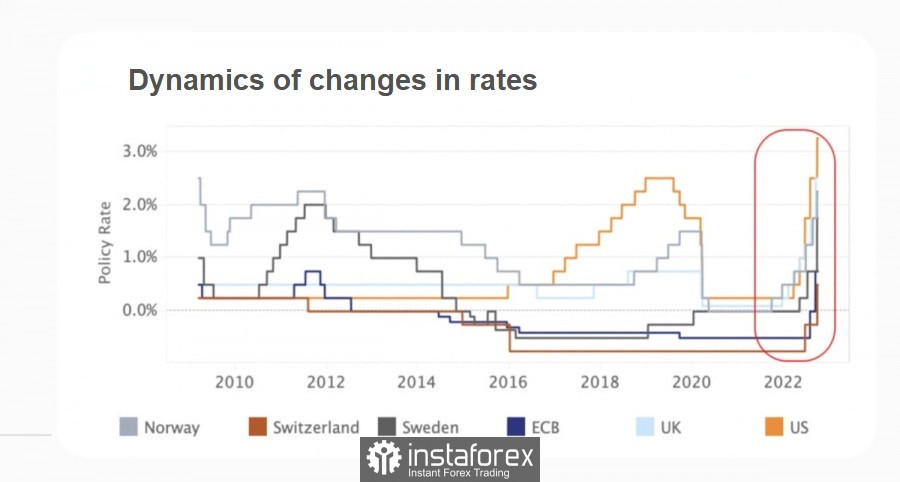

In 2022, most central banks launched an aggressive monetary policy aimed at fighting inflation by reducing the availability of money. Due to the decrease in financial opportunities, the level of interest in risky assets also falls.

The main indicator of interest in high-risk assets is the DXY index. The indicator is gradually starting to decline, while the SPX has shown growth for three days in a row. In the short term, this may mean the emergence of a local bullish trend for major cryptocurrencies.

ETH/USD Analysis

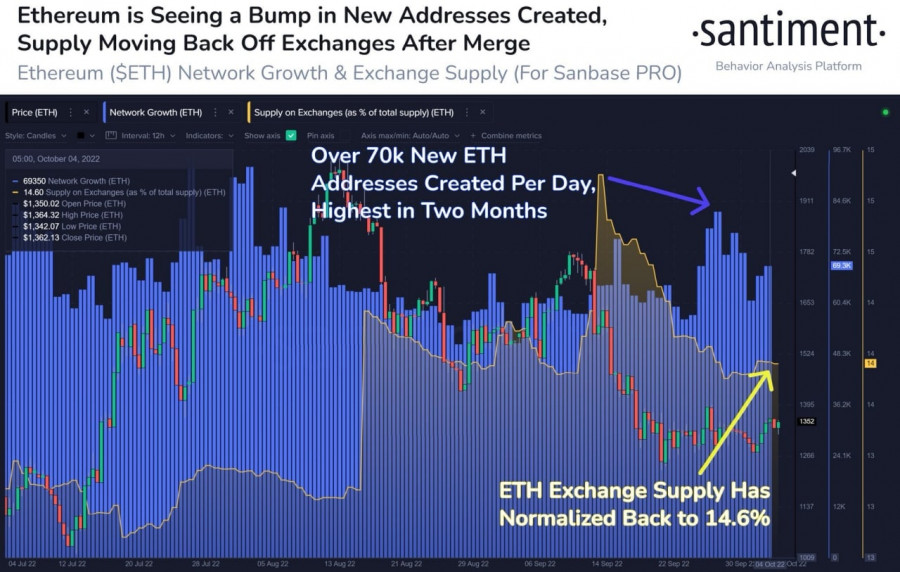

The main altcoin continues to move within the framework of consolidation in the range of $1,200–$1,400. The cryptocurrency cannot go beyond the zone due to the downward trend line. As of October 7, ETH trading volumes are not enough for a full breakout.

Technical metrics continue to point to the continuation of the flat price movement. RSI and stochastic are moving in the bullish zone but without hints of bullish signals. However, given the low trading volumes, if the price breaks out of the range, then this will be an impulsive movement.

At the same time, Santiment analysts point to the active growth of new ETH wallets. Glassnode also noted that the number of ETH addresses with a balance of 1 Ether reached an absolute maximum of 1,580,000. This is a positive signal indicating a growing interest in the altcoin, and as a result, an increase in trading volumes.

For the past two weeks, ETH has stood still without significant attempts to break out of the range. Given the approaching DXY correction, as well as the growing interest in Ethereum, we should expect the emergence of a local bullish trend. However, it is unlikely that the trading volumes needed to move up will appear over the weekend.

BTC/USD Analysis

The main news regarding BTC was the increasingly obvious uncorrelation with the S&P 500 stock index. Formally, assets retain the similarity of the dynamics of price movement.

However, Bitcoin does not come close to implementing the upward jerks that SPX makes. This may indicate a worrying trend that the upcoming DXY correction will be a bullish leg for the stock market. Throughout the week, the US markets have been talking about the high potential of the S&P 500, NASDAQ, and Jones.

As a result, BTC formally follows SPX, but most of the investment is concentrated in the stock market. If this fact is confirmed, then the potential for the likely upward movement of Bitcoin will be much less.

Despite the disturbing news about the "relationship" between cryptocurrencies and stock indices, there are also positive signals. Glassnode analysts noted that more than 45% of all BTC have not moved for two years. This is an important signal indicating a high level of long-term investors, who are the main fuel for the fundamental value of the asset.

In addition, CryptoQuant shed another ray of light on Bitcoin's commitment to the $20k level. Experts believe that the price of the cryptocurrency is at the level of the aggregate breakeven of institutional investors. This could be another reason for the strong support zone near $20k.

Miners continue to be the main suppliers of BTC to crypto exchanges. One of the major American miners, Core Scientific, produced 1,213 in September, which is not 9% less than in August. At the same time, the company had to sell 1,576 BTC, which negatively affected the price of Bitcoin.

Conclusions

One by one, Fed officials have announced low chances for monetary easing in 2023. Powell has adjusted his inflation forecast for 2023, and now the acceptable figure is at the level of 3%. It's an admission that part of inflation is out of control.

With this in mind, cryptocurrency trading volumes will remain near the lows. Therefore, the main stages of price growth will be the correction of the US dollar index. In the medium term, the forecast remains valid—cryptocurrencies will start to grow, and the first visible signals for this may appear next week.