The EUR/USD currency pair traded cautiously on Wednesday evening and throughout Thursday. On one hand, the outcomes of the European Central Bank (ECB) and Federal Reserve (Fed) meetings were precisely as anticipated. On the other hand, these were still central bank meetings, yet the market reacted as if they were merely business activity indices. We had cautioned in previous articles against jumping to conclusions too quickly. After significant events, the market always requires time to fully process the information and reveal its final reaction. As it turned out yesterday, there wasn't much to process.

The ECB lowered key interest rates as expected. During the press conference, Christine Lagarde stated that the central bank is prepared to continue easing monetary policy, with inflation expected to stabilize around 2% by 2025. She also mentioned that economic growth in the Eurozone is very weak and that Donald Trump's tariffs could potentially reignite inflation. However, at present, the ECB remains committed to its clearly defined course.

The Fed decided not to change the key interest rate, which was also anticipated. Jerome Powell noted that the economy is performing well, the labor market shows no signs of concern, and Donald Trump will not be able to influence the Fed's decisions. We believe that this statement alone could have triggered a strengthening of the U.S. dollar, as it addressed one of the most pressing concerns. While the dollar did enter an uptrend, the market's reaction was relatively weak.

We believe that GDP reports hold significant importance. In reality, market participants do not always pay attention to these figures, but that is not the main point. What truly matters is the broader fundamental context surrounding a particular asset. For over a year, we have been discussing the weakness of the European economy, viewing it as one of the reasons for the euro's decline.

What did we learn recently? Germany's GDP contracted by 0.2% in the fourth quarter, while the forecast was -0.1%. Additionally, the Eurozone economy posted 0% growth in Q4, failing to meet the already modest expectation of +0.1%. We have long argued that the Eurozone is in a state of total stagnation and now cannot even meet minimal growth forecasts.

Therefore, we maintain our stance: the euro will continue to decline due to the weakness of the EU economy, which shows no signs of improvement. Furthermore, the ECB is prepared to cut rates not just to 2% (the neutral level) but potentially even lower. Although this possibility is not being openly discussed yet, it exists. Meanwhile, the U.S. economy remains strong and stable, and the Fed is unlikely to respond to pressure from Donald Trump by cutting rates more than 0.5%. This suggests that by the end of the year, the Fed's rate will be at least 4%, while the ECB's rate could be below 2%. We see no reason for the euro to appreciate.

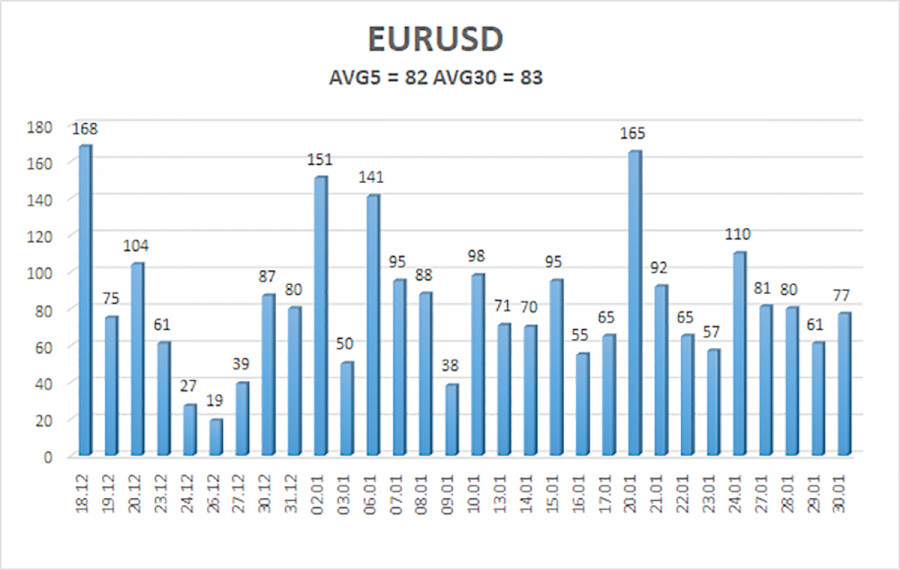

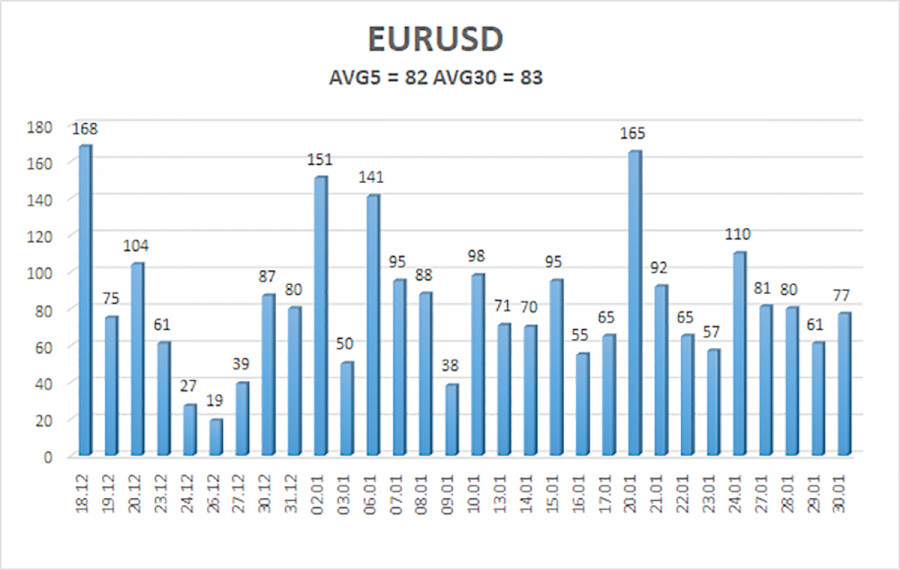

The average volatility of the EUR/USD currency pair over the last five trading days as of January 31 is 82 pips, classified as "average." We expect the pair to move between the levels of 1.0341 and 1.0505 on Friday. The higher linear regression channel remains downward, indicating that the global downtrend is intact. The CCI indicator entered the overbought zone and formed a bearish divergence, after which a new decline began.

Nearest Support Levels:

S1 – 1.0376

S2 – 1.0315

S3 – 1.0254

Nearest Resistance Levels:

R1 – 1.0437

R2 – 1.0498

R3 – 1.0559

Trading Recommendations:

The EUR/USD pair is currently experiencing an upward corrective movement. Over the past few months, we have consistently expressed our expectation that the euro will decline in the medium term, and we believe this downward trend is not yet over. The Fed has paused its monetary policy easing, while the ECB is accelerating its easing measures. As a result, there are no fundamental reasons for a medium-term decline of the dollar, aside from purely technical and corrective factors.

Short positions remain relevant, with targets set at 1.0254 and 1.0193, but we need a clear indication that the current correction has concluded. For those trading based on "pure" technical analysis, long positions may be considered if the price is above the moving average, with targets at 1.0498 and 1.0505. However, it is important to note that any upward movement is currently classified as a correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.