If you are making your first steps in trading, everything may seem too complicated and difficult for you. We are referring to both terminology and technical aspects.

In this article, we provide a full insight into the basics of trading: everything you need to know about and have to make your trading start as easy and convenient as possible.

Key terms

Before we go into reviewing the basics of trading, let us provide you with some explanations that every beginner should know about.

- Trading means activity in financial markets where everyone sticks to one simple principle: buy low, sell high. This principle applies to all markets out there: stocks, currency, fiat, commodities, and other.

- An asset is a trading instrument that a trader makes deals with to get profits. There are various types of assets including securities, currency pairs, cryptocurrencies, metals, and other. The assets can be underlying (the ones mentioned above) or derivative (such as futures and other).

- A trade is an action of buying or selling an asset. Buy trades are also called long, while sell trades are the short ones. However, these names have nothing to do with the duration. Every buy trade always end up with selling, and vice versa, every sell trade results in buying.

- An order is an instruction to a broker to buy or sell a particular asset. As commonly accepted, there are market and pending orders. When placing a market order, a trader wants their trade to be executed at the current price. A limit (pending) order gets executed when a price reaches a certain level defined by a trader. Sometimes, it happens that a price never reaches the specified level, so such a pending order expires.

- Bulls and bears are the market participants whose activity influences the supply and demand ratio. Bulls are buyers who want an asset price to grow. Their counterparts are bears, i.e. sellers, who are interested in falling prices. When the market is controlled by bulls, it means that the trend is upward, while the market under bears’ control means that prices are decreasing.

What are the essentials to start trading

As any activity, trading requires some training. Besides, everything that concerns financial aspects should be paid due attention, time, and efforts.

For a successful start, you need:

1. Obtain theoretical basis. For this, you can participate in webinars, search for useful information on the Internet, get some training courses, read books about trading, and so on.

As a rule, many brokers offer a plenty of useful information. Specifically, InstaForex has a special section for beginners on its website.

In addition, you can subscribe to blogs and social networks of successful traders to learn how their work is organized.

2. Get some practical skills. The easiest way is to trade on a demo account, for example, the one offered by InstaForex.

When working on a demo account, a beginner can try their skills without risking real money. Demo accounts have virtual funds, so their users can use them in trading. Consequently, both losses and profits on such accounts are virtual as well.

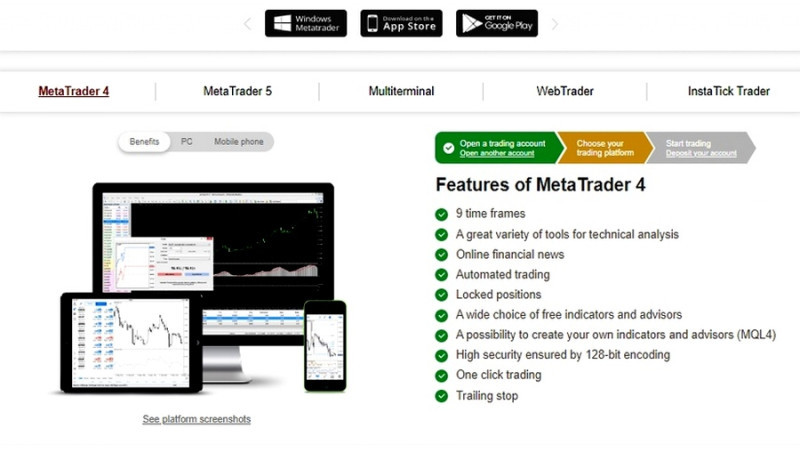

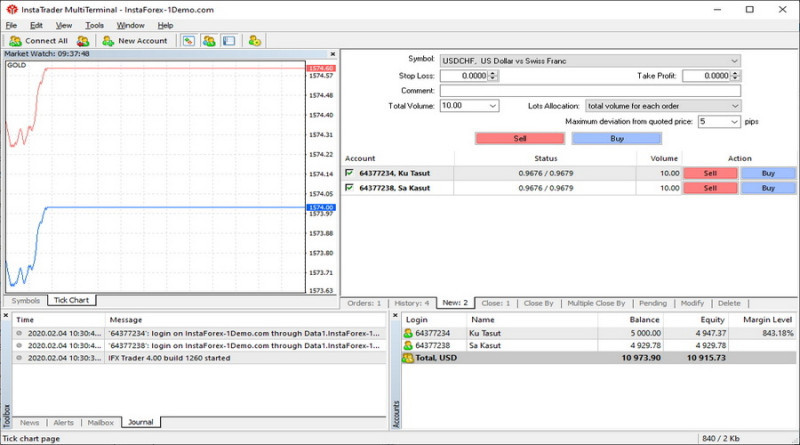

3. Learn how to use a trading platform, a key tool for any trader. The most popular trading platforms are MT4 and MT5. However, brokers often provide other options, including the self-developed software.

Specifically, InstaForex provides a variety of trading platforms which run on various operational systems and can work on various devices (computers, smartphones, or tablets).

Some experts recommend trying several platforms on a demo account.

4. Choose a broker, a company that serves as an intermediary between a trader and a financial market. We will provide more information about brokers further on. Meanwhile, let us pay attention to the key criterion.

We are referring to the trading conditions offered by a broker. These include account types, leverage policy, deposit and withdrawal methods, commissions, and other.

These conditions play a key role in trading while affecting its efficiency. So, it would be wise to compare conditions offered by different brokers to choose the one that suits your needs best.

5. Make sure that your device is operational. It does not matter whether you use a computer, a tablet, or smartphone - the main thing is that it works with no failures. Besides, its capacity should be enough to maintain uninterrupted connection and avoid any lags. In addition, it is important to install reliable antivirus software. Such preparations can take some time. One should not hurry to achieve any positive results. The key thing is to find answers to all burning questions before starting to trade in real conditions.

What are the theoretical basics?

What do you need for Forex Trading? There are numerous ways to learn the necessary information about trading. Particularly, you can take individual or group courses that are described in more detail in the article Trading courses for beginners.

No matter what way you choose to get the understanding about trading, the information can be classified as follows:

- Trading basics. This section includes an introduction to basic trading terms, financial markets structure, and so on.

- Risk management. This section is devoted to the main principles of capital management that will help you trade safer. For example, this is the information about possible risks (per one trade or per day) or about the trading system structure that implies gradual increase of the trade volume. If a trader learns the principles of risk management, they will be able to avoid huge losses by not investing big amounts of money at once.

- Information about various assets. Traders can profit from speculating on securities, cryptocurrencies, currency pairs, and other assets. It is quite important to learn everything about them and to choose any particular asset. For a beginner, it is enough to start with one or two assets, and increase their investment portfolio later.

- The process and principles of market trading. This block includes chart analysis, opening and closing trades, creating a trading strategy, using various forecasting methods. This implies the study of technical and fundamental analysis, and learning the indicators that can be used. Also, traders need to pay attention to trading tactics and styles, as well as trading methods.

This knowledge lays the foundation for the future trading activities. Simply put, it helps a trader to decide how often to trade, what style to use and under what conditions to enter and exit the market.

Where to find information

There will definitely be no problems with finding materials to start trading. For example, you can study special literature described in the review best books about trading.

Beginners often prefer finding information on the Internet. There are two types of such sources:

- Commercial

- Independent

In the first case, the content is created to promote a brokerage company, a trading product, and so on. For example, it can be a description of the author's strategy or indicator, created for the customer.

As a rule, such content has distinctive characteristics:

- It is intended for the creation of a positive image of some product or service, so such content includes links leading to receive the product or service.

- Comments, if any, are mostly positive and come from newly registered users. Moreover, the same comments may appear on different sources.

Independent content is created for the informational rather than commercial purpose. Its audience is both beginners and professionals.

For example, for novice market participants, training video tutorials, webinars, glossaries, master classes, and so on are suitable. Traders who already have at least minimal experience in trading may be interested in analytical articles or forecasts.

At the same time, the boundary between information for beginners and professionals is very blurred. For example, news and data from the economic calendar will be useful for both categories of traders.

A huge amount of information can be found on the Internet. Its sources may be:

- Brokers’ websites

- Blogs of professional traders

- Websites of financial organizations and companies whose activity is associated with trading, such as trading software developers

- Trading forums.

Useful literature

One would be surprised to hear that in the current era of computer technology, books can be a useful source of unique information. To learn more about such books, read the article Best trading books.

Some books best suit professionals, while other books can be of interest to beginners who are making their first steps in trading.

Here are some of the books that can be useful to both novice and experienced traders.

- “Great Investors” is a self-explaining title. Its author Glen Arnold shares the success secrets of George Soros, Warren Buffett and other successful investors.

- “Reminiscences of a Stock Operator” by Edwin Lefèvre is a story about the life and achievements of famous stock trader Jesse Livermore. In this book, particular attention is paid to the psychology of trading.

- “The Wolf of Wall Street” is an autobiographical book by Jordan Belfort, a broker who admitted his mistakes. Quite often, this book is referred to as a guide to avoiding fatal mistakes.

- “The Small Encyclopedia of the Trader” by Eric Nyman tells readers about the basics of trading activity in financial markets. Many experts believe this book to be a must read for all beginners.

- “The Active Trader's Course” by Alexander Gerchik. In this book, the author tells readers about his own trading experience, starting from the basics and ending with the use of complicated strategies.

The given list is only a small part of the books that can be of benefit to traders. However, it does not mean that you need to read all these books before you start trading.

It is advisable to study and learn something new non-stop, even when you are already an active trader.

What are trading platforms for?

As already mentioned, a trading platform is basically a work tool for any trader. You can find out more about most popular platforms in the article Best trading platforms.

Without going much into details, a trading platform is software that provides users with access to the market. In this case, a broker acts as an intermediary that provides a platform.

Using a platform, a trader can:

- Trade, that is, open and close transactions

- Make a deposit in order to continue trading

- Access the history of all completed transactions

- Analyze charts of changes in prices, receive data on current quotes

- Stay up to date with the most important news and events. As a rule, platforms are equipped with news feeds

- Adjust timeframes, use indicators.

Therefore, any platform performs the following functions:

- Receives trading information such as quotes, news and so on

- Assesses the market situation, which allows you to use various tools for technical and graphical analysis

- Manages the trading process

- Analyzes trading results

- Controls and manages trader’s funds. Here we are referring to both the creation of real and demo accounts, as well as statistical data on profitable and unprofitable transactions.

In a great variety of trading platforms, there are three main types:

- Mobile platforms are the ones that are installed on smartphones and tablets. Their main advantage is convenience, because apps can be used anywhere. At the same time, mobile platforms have limited functionality, as a rule.

- Browser-based platforms do not require installation on a device and can be used directly in a web browser.

- Desktop platforms have the most advanced functionality, but require downloading and installation on a computer or laptop.

Psychological aspect

Many professional market players are sure that their success depends not only on knowledge and skills, but also on their psychological readiness.

When trading, a person may feel different emotions. Most often it is fear, anger, greed, euphoria and impatience.

When any of the above emotions runs too high, the result can be unpredictable:

- A trader incurs losses though their strategy seems to be correct

- A trader invests too much or, on the contrary, not enough money

- A trader is either too focused on potential risks or does not pay any attention to them at all.

To balance off your psychological state, we recommend you do the following:

- Read books about traders’ psychology. The most famous authors are Brett Steenbarger, Mark Douglas, and Jack Schwager.

- Take a psychological test and, based on its results, try to resolve weak points in your reactions and behavior;

- Make up a clear and detailed trading plan describing your actions in any, even the most unpredictable, situations.

- Learn how to control emotions: it is important to stay calm and adequate about both profits and losses. Don't get carried away when you win, and never try to win back when you lose.

- Keep a journal that briefly describes the prevailing emotions in the process of opening and closing trades. This will help you understand how your psychological state and your trading results are connected.

- Use the tactics that correspond to your type of temperament and character.

Trading devices

In most cases, traders use desktop computers. You can learn more about this in this article: Best computer for trading.

Regardless of what device you use, it should:

- have high performance with no lags,

- provide high speed Internet access,

- have enough RAM,

- comply with the technical parameters of a platform that can be found in the instructions for the platform,

- have a well-functioning ventilation and cooling system.

If you choose between a computer and a laptop with the same technical characteristics, then both options are excellent. The only difference is that the laptop allows you to work outside as long as there is enough charge.

Another important criteria is the screen size. The most optimal size is 30 inches, which will enable a trader to see all necessary information.

At the same time, many of the latest laptop models have a smaller diagonal, such as 15 and even 14 inches. That is why professionals most often opt for desktop computers.

Here are the key characteristics of a device that meets the requirements for trading:

- The screen diagonal is at least 19 inches. If size is smaller, you may miss important signals, and there will also be a strong strain on the eyes.

- The processor is quad-core with the frequency of 3.6 GHz.

- The RAM should be at least 4 GB while the SSD should be no less than 128 GB.

- It should have a matte monitor.

- Also, you may need uninterruptible power supply for the cases of power outages.

How many monitors should a trader have?

When choosing a computer for trading, you may face certain dilemma regarding the choice of a monitor. You can find the solution in this article: Best monitors for stock trading.

For beginning traders, one monitor is quite enough. But if you decide to engage in activities in the markets seriously, then it is better to have more than one monitor.

The thing is that a trader gets tired of constantly switching between working charts of quotes, windows and timeframes. If there are several monitors, there is no such problem.

The number of monitors you may need depends on the following criteria:

- The list of assets that you trade;

- The list of indicators you use;

- The number of information sources you refer to;

- Your trading strategy and tactics.

Some experienced traders who trade large volumes and work with different assets have about 6 or 8 monitors which are kept on a special rack in their workspace.

Important criteria:

- A video card: the number of outputs in it must be equal to the number of monitors. In this case, you can use several cards.

- Fastening: devices can be located both on a table, and on a floor or on a wall. Importantly, they should not overlap each other. You can make a monitor stand yourself, or you can buy a ready-made one. But the brackets are better only to purchase;

- Video cables: their type should match the model and specifications of the video card. It is also important to have a sufficient number of outlets with voltage stabilizers and extension cords.

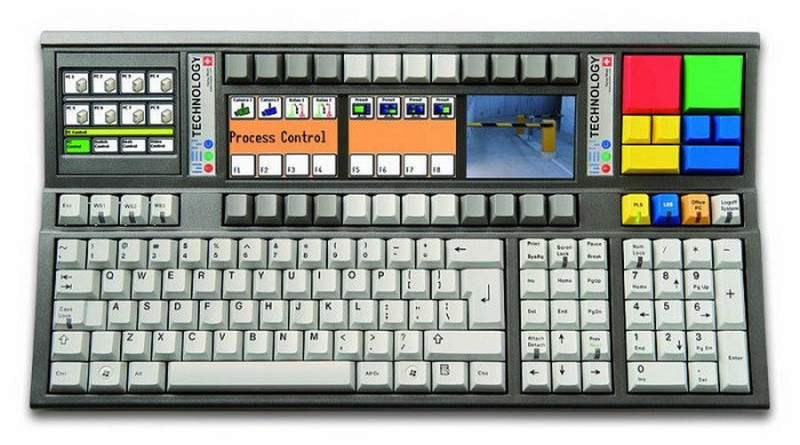

What is about a keyboard?

Some beginners do not pay enough attention to keyboards, though they also play an important role. Read about the best options in this article: Best trading keyboards.

Nowadays, there are many different models on the market. The difference between them is both the price and characteristics. Here you need to factor in your personal preferences and financial capabilities.

For example, there are mechanical and membrane keyboards. The first option is relatively noisy, since each time the key is pressed, a click is heard, but it is faster.

The membrane keyboard is almost silent and costs less than a mechanical one. But it needs stronger keystrokes and breaks down faster.

Additionally, keyboards have different connection methods. There are wireless and USB types.

Wireless keyboards are more attractive from an aesthetic point of view, while those equipped with a USB connector are considered the most reliable.

Besides, keyboards may have some additional useful options:

- additional buttons for opening applications, controlling volume, brightness, and so on;

- touchscreen;

- different arrangement of keys for left-handers and right-handers;

- dynamic lighting.

Also, there are keyboards created specifically for trading purposes. Even outwardly, they differ from classical models.

In particular, there are trading keyboards manufactured by Bionic Trader or Wey Technologies. Such keyboards cost hundreds of US dollars.

Smartphone functions

Trading via mobile devices is convenient. The key task in this matter is to choose the Best trading app for smartphones.

The key advantage of mobile trading is that traders have an ability to trade wherever they are.

At the same time, it is important to know that some platforms do not have mobile applications, or rather, not some brokers do not provide trading platforms to clients. Therefore, if you are going to use a smartphone for trading, make sure that your broker offers such an opportunity.

When choosing an application, it is necessary to take into account the device characteristics:

- Make sure that OS of your device is compatible with the app. There are different variants for Android and iOS.

- The screen of the device should be no smaller than 5.5 inches, because you will not only have to make deals, but also analyze charts and indicator signals.

The stable and uninterrupted Internet connection is also important. If the network is accessed at a low speed or there are constant failures, this will negatively affect both the trading process and its effectiveness.

When trading on a mobile device, a user can:

- Keep track of asset prices in real time

- Open and close trade, set stop loss orders

- Use various charting tools

- Polish one’s trading skills on a demo account

- Use indicators to forecast future price movements.

More often, scalpers are the ones who trade mobile. Constant access to the market is essential for them because they need to react promptly to any changes in the market.

Trading on a tablet

What do you need for Forex Trading? A tablet is another mobile device that can be used for trading. To learn more about choosing the suitable table, read this article: Best tablet for stock trading.

Nowadays, manufacturers offer different options for tablets with a connected keyboard. Many traders considered such options the most suitable for mobile trading.

Firstly, they solve the main problem of smartphones, which is a relatively small screen. Secondly, unintentional errors that may be associated with the use of touchscreens are eliminated.

When choosing a tablet, pay attention to the following factors:

- RAM,

- Weight: tablets heavier than 800 grams are not worth buying,

- The Bluetooth feature,

- An in-built Wi-Fi receiver,

- Operating time without additional recharging,

- A slot for a memory card,

- The screen size. The optimal range is from 8 to 10 inches. First, this size is enough for comfortable work, second, such a device does not take up much space and is convenient to carry around.

Let us separately drop a few words about operational systems on tablets. Besides Android or iOS based tablets, there are also desktop versions on Windows or Mac OS.

Some experts believe that desktop operational systems are more suitable for trading as they can solve more tasks.

At the same time, it is worth noting that powerful tables are costly. Sometimes, their price is higher than a laptop price. Therefore, before buying a new device, you should weigh the pros and cons.

How to select a platform

A platform which you will be using for trading plays an important role for both newbies and experienced traders. To learn more about the most advanced platforms, read the article Best trading platforms.

Here are some criteria that should be factored in when choosing the best option.

- Functionality is one of the most important factors, because the effectiveness of trading largely depends on platform functions. This includes a list of tools for analysis, a variety of timeframes, available scripts for installation and types of charts;

- Simplicity and convenience. The interface should be straightforward and customizable.

- Specifications: it is important that the platform works without failures and is compatible with the software installed on a trader’s device.

Another important factor is that every platform serves to achieve certain goals and objectives. This should also be taken into account when choosing a platform.

For example, MT4 is considered the best option for trading currency pairs, while MT5 is a platform for trading stocks.

Beginners should keep it in mind that a broker provides access to a specific platform. That is, each brokerage company provides a particular trading platform to its clients. Sometimes, there are several such platforms.

To evaluate the pros and cons of a particular platform, it is recommended to register a demo account for a start. It is free, does not carry any financial risks, and allows you to trade in market conditions that are identical to real ones.

With InstaForex, the process of opening a demo account is simple. It only takes a few minutes.

What is the role of a broker

A broker is an intermediary providing retail investors with access to financial markets. To learn which brokers are best, read the article How to choose a broker for Forex trading.

The activities of brokers are regulated, that is, the legality and transparency of all transactions is under the control of the regulatory authorities that issued their licenses. For example, in the US this function is performed by the SEC, in Cyprus by the CySEC, and in the UK by the FCA.

InstaForex is regulated by the FSC of the British Virgin Islands.

Remarkably, some brokers are not regulated at all. In such cases, traders may find it difficult to solve any dispute.

To explain how brokers work, let's compare their activities with the activities of traders.

The difference between brokerage companies and traders:

| Trader | Broker |

| Is a client of intermediary | Acts as an intermediary between the market and an individual |

| Uses a platform | Provides a platform to a client |

| Analyzes the market, opens and closes trades by sending relevant orders | Executes buy and sell orders received from a trader |

| Depending on trading results, gets profits or incurs losses | Charges clients a commission which does not depend on the trading results in most cases |

In fact, traders cannot carry out their activities without a broker, and a broker cannot carry out its activities without the clients, that is, traders. At the same time, a trader is an individual, while a broker is a legal entity.

The most important requirement for a broker is its reliability, because their activity concerns financial aspects. The ideal option is when a company opens segregated bank accounts and keeps clients' money on them, that is, separately from their own funds.

How to use signals

What if you lack the necessary knowledge and skills to achieve desirable results in trading? To solve this problem, try using trading signals whatsapp for WhatsApp, Telegram, and other messengers.

For a start, let us explain what trading signals are. This notion means recommendations for taking specific steps in the current market conditions.

For example, it can be a recommendation to open a trade on a particular asset or within a chosen time frame. Alternatively, it may be a recommendation to close a trade.

Trading signals are usually provided by professional traders or legal entities connected with trading, such as brokers.

Such recommendations can be provided for free or their can be paid for. The daily subscription costs about $5-10.

Visually, a trading signal is a short message containing some hint for a trader. It can be:

- A recommendation on which asset it is advisable to choose for trading at the current time.

- Advice on what price to buy or sell it for.

- A hint for setting stop loss and take profit.

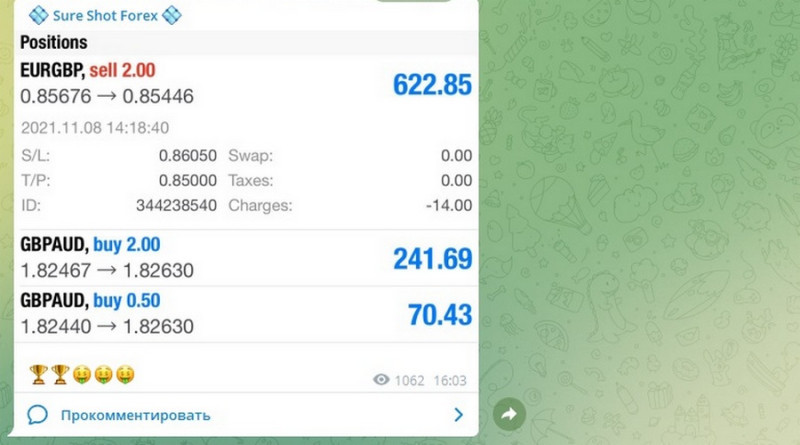

On the screenshot below, there is an example of a Telegram trading signal. It refers to several currency pairs, including stop loss and take profit levels for EUR/GBP.

Importantly, any signal can only be used immediately after receiving, because even after a short time it can become irrelevant and lead to losses. In addition, no signal gives a 100% guarantee that the transaction will actually turn out to be profitable.

Must-have tools

To achieve certain trading goals, all market participants use trading tools. These are the kind of assistants without which trading would be complicated or in some cases impossible.

There are paid and free trading tools. Most of them can be found in the public domain, some are built into platforms, while others are easily added there.

Here we describe the most important tools. We will skip the part about platforms because we have already touched upon this issue above.

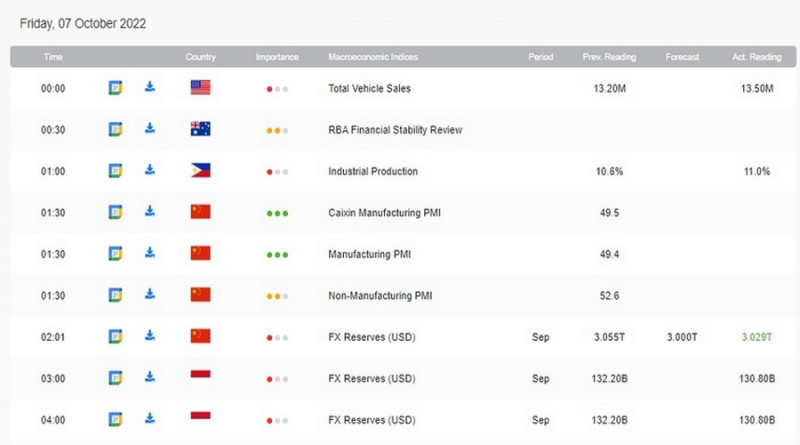

- An economic calendar that contains a list of all the most important economic events that may affect the market situation. Most often, such calendars are published on the websites of brokers, while InstaForex has an advanced version where all events are marked according to their importance.

- News on economic and political topics in the world and national media, decisions of regulators, statistics on mining, and other important facts influence market dynamics. You can track the release of the most news on various information resources, as well as on the broker's websites or directly in the platform.

- Calculators that help with mathematical calculations. Most often, these are online services that calculate the cost of a pip, assess volatility, and compare brokerage spreads.

- Trade log contains information about all trades. It is important for traders to keep a trade log in order to analyze their activities and correct mistakes.

- Advisors and indicators that can improve performance.

- Software for automatic trading, in which case trades are opened and closed by robots.

What assets to trade

As a rule, every experienced trader has a set of assets that they trade. These can be trading shares for beginners, currency pairs, cryptocurrencies, and other.

This great variety of assets is divided into two groups:

- Base, or underlying, assets

- Derivatives.

The underlying assets are stocks, currency pairs, stock indices, commodities, and other. We will not go into details, because the names of these assets speak for themselves.

The derivatives are:

- Futures are contracts that involve the delivery of a certain asset after a certain period of time at a price specified in the contract. Delivery can be both actual and theoretical: in the second case, one side pays the difference between prices to the other.

- Forwards are basically the same as futures, but the supply of assets is always real, that is, there is no speculation on the price in this case.

Most often, derivatives are used to expand trading opportunities when it is impossible to work with underlying assets. For example, when a certain basic asset is expensive and a trader’s financial situation does not allow them to be purchased.

It is also one of the ways to test arbitrage strategies on global markets, or to hedge investments in securities, currencies, and other underlying assets.

Conclusion

Hopefully, this review “What do you need for Forex Trading” has helped you to understand what are the essential things to start trading. All this information may seem to be too complicated, but don’t worry. As practice shows, in the process of work, all gaps in knowledge are eliminated, and efficiency increases.

Back to articles

Back to articles