Did you know that you can use the tips of professionals in the process of trading? This article will tell you about trading signals.

You can also read the article What do you need for Forex trading to learn about the basics of trading. You will learn what trading is all about, how to get started, and what tools you need to get started.

Understanding trading signals

Sometimes novice traders find it difficult to determine the best moment to enter and exit a trade. Trading signals can help to take the right decision in the market.

These signals or tips are a kind of trigger that makes a user take a trading decision.

They advise on when it is better to open a position, at what point in time, and at what price it is worth closing it. This can refer to trading on Forex as well as on other platforms.

For example, tips are used when working with cryptocurrencies, securities, and other assets.

That is, a signal is a trading idea from a professional, which concerns a specific instrument and should be applied at a certain time if the specified conditions are met.

Professional traders, reputable sources, specialized companies, and brokers provide such ideas. They study the market and make predictions about how the price of an asset will change in the future.

They provide this information to subscribers. Sometimes such services in trading are free of charge.

Meanwhile, the price can range from $5 to $10 per day, and if you sign up for a package of services with a one-time payment, the price of a subscription can reach hundreds or even thousands of dollars.

Free signals are usually sent out less frequently, they may be accompanied by advertising and contain no explanation. For example, the user receives a notification that he or she needs to buy an asset at a specified price but why it is important to do so now is not explained.

You have to pay money for paid trading advice, but you will receive better quality content with detailed explanations, charts, and so on.

Most often, signals - both paid and free - are short text messages. They may contain recommendations on:

- Opening or closing a trade;

- Buying or selling an asset;

- Stop Loss and Take Profit levels.

When using them, it is important to consider two important things:

- Usually, signals are short-lived as market conditions change very quickly, especially when it comes to assets with high volatility. If the message was delivered (read) with a delay, using a recommendation can do more harm than good;

- No signal can guarantee profits. That is why you should not hope that a ready-made trading idea will instantly multiply your deposit.

Trading signals has the following advantages:

- improving trading skills. By analyzing the recommendations, a trader learns to apply different strategies, to determine the optimal points for making trades;

- saving resources. To develop trading strategies, traders need knowledge and experience.

- use of recommendations allows using efforts and time rationally;

- possibility to diversify the investment portfolio. Application of ready recommendations contributes to the expansion of the list of assets, which increases the efficiency of trading;

- minimization of psychological burden in trading. It is especially important for scalpers who make transactions quickly and often, being in constant emotional tension.

In the received signals, a trader can find answers to the following questions:

- What exactly is the right asset to use at the current moment of trading?

- At what price should a trader buy and sell an asset?

- At what levels is it better to place SL and TP orders?

Trading signals are used both by beginners and experienced traders. Beginners use them to learn more about trading, while professionals improve their financial performance.

However, if you use people's trading signals from other traders, you may notice that there are several disadvantages. Here are the main ones:

- there is a risk of encountering unscrupulous providers who are not interested in increasing the efficiency of your trading. Trust only those providers who are engaged in trading themselves and can demonstrate their trading results;

- no guarantees. Any idea, even the most accurate one, can lead to losses;

- financial costs. Many trading tips are paid.

Types of trading signals

Currently, there are several approaches to the classification of signals for trading. Let us dwell on them in more detail.

The first classification implies that trading signals can be on their content and method of generation.

Here we can distinguish the following types:

- Signals that involve copying trades. In this case, a trader gets access to the market actions of a professional. For example, if an experienced trader opens a long position on a particular asset, such a transaction is automatically copied by the subscriber of the service.

That is, there is a copying of trading ideas of another, more experienced market participant. At the same time, in some cases, a copy trader can adjust the performed operations and even cancel them, if necessary.

- Signals that are received independently. Most often we are talking about signals generated when using indicators.

In this case, a trader spends more time making decisions but they are completely independent in decision making. The advantage of this method is that many indicators are built-in trading platforms (for example, MetaTrader) and are free of charge.

If you do not have a suitable option, you can add it to your trading platform. Most platforms provide this possibility by downloading additional plug-ins;

- Deposit management-oriented signals. These signals involve the transfer to a so-called manager of the rights to fully manage the trader's trading account. That is, the manager decides what part of the deposit and in what assets to invest, and when it is best to do so.

The owner of the deposit sometimes does not even have information about what trades are made by the provider of such services. The main thing, in this case, is the financial result.

The second classification is based on the degree of automation.

- automated trading signals. Special software not only gives recommendations on trading decisions but also performs them instead of a trader. This implies the use of robots and advisors.

The main advantage of this option is the minimization of subjective factors. Computer programs do not give in to emotions, their effectiveness does not depend on their mood.

They can analyze a much larger amount of data compared to humans. At the same time, professional traders do not recommend automating trading completely as you may lose trading skills;

- manual. A trader manages his deposit and decides when to open a trade and when to close it, using signals.

Many specialists believe that it is better to stick to semi-automatic trading when working with signals. That is, it is better not to rely solely on robots but to take responsibility for making trading decisions yourself.

The third classification assumes the division of signals based on the type of analysis that is used to obtain them. The signals can be:

- news as a result of fundamental analysis. For example, it can be a recommendation to buy a specific currency, taking into account the news about the change of trends in the market;

- technical, received after technical analysis is conducted. For example, the rising price of a selected asset has broken through a resistance level, based on which the user receives a recommendation to open a long position.

The most common are technical tips. In this case, many providers combine both options when generating trading ideas.

The fourth classification is based on how ideas are delivered to customers. There are the following options:

- social networks, messengers (Telegram, WhatsApp, Viber);

- alerts in text messages;

- email messages;

- copying transactions directly on the platform.

Large providers usually offer their clients several communication channels. For example, they do a Telegram mailing list and duplicate it to subscribers' email accounts.

The fifth classification implies the division of recommendations into short-term (time frames up to 15 minutes), medium-term (daily time frame), and long-term (time frames higher than D1). In the first case, the user's efficiency in making a decision is very important.

Useful tips for trading signals

You can find a lot of trading signal providers on the Internet. Most of them promise maximum benefits but no one openly talks about what the pitfalls may be.

For example, quite often users are told about a guaranteed profit of 70-80%. Perhaps, this data is historical and was in the past.

However, there is no guarantee that these values will remain in the future. Therefore, one should not fully rely on the promised results.

When using trading tips in trading, it is better to follow these recommendations:

- If you start to use ready-made trading ideas, do not risk large sums. Increase the volume of transactions only after you are confident in the effectiveness of the signals you receive;

- If you have chosen a paid subscription, specify the refund conditions. This is important if the service costs a lot of money but it does not meet your expectations;

- Be wary of providers who demand a subscription fee for their ideas. Such an approach by a provider may indicate that it is primarily focused on financial gains, rather than generating accurate and effective signals;

- Double-check the recommendations. Thus, you will protect yourself from losses. For example, sometimes it is better to use time frames from one hour and higher to have time to read the news and experts’ forecasts;

- If possible, communicate with your provider. Do not hesitate to ask why he has made this or that decision, and what other options there might be;

- Pay attention to the statistics of transactions. When the provider hides data on loss-making operations and demonstrates only winning ones, this should put you on the alert. Conscientious providers publish all results without exception.

The trader's actions when using the received ideas can be as follows:

- Sign up for notifications;

- Study forecasts for the selected asset, and analyze its price movements. It is important to see if there are technical grounds for opening a position on the chart;

- Receive a signal from the provider and compare it with your forecast;

- Make a trade if your forecast matches the signal you have received. If there are significant discrepancies, it is best to refrain from buying or selling.

How to choose signals provider

Signals can be used in trading not only by beginners but also by those who have trading experience. Firstly, ready-made recommendations can increase traders' opportunities. Secondly, they save users time spent on analyzing the market.

It is necessary to choose the right signal provider if you want recommendations to work for you. When choosing a provider, one should consider the effectiveness of the trading activity first.

You can evaluate a signal provider by the following:

- The period of existence of the trading account, the number of open and closed deposits. The active account must be active for at least a year because if the period is shorter, it will be difficult to conclude the success of the trades.

When a provider has a lot of closed accounts, it is necessary to find out the reason for this. If it is impossible, you should consider choosing another provider;

- Statistical data on trading activities. Here we should pay attention to the ratio of profitable and loss-making trades, the size of the drawdown, etc.;

- The number of subscribers. The greater the number, the more reliable and successful the selected provider is.

It is easy to assess the effectiveness of signals received in messengers, social networks, and other communication channels. To do this, it is enough to open a demo account and apply ideas in practice, without the risk of losing your money.

As for trade copying, or social trading, everything is more complicated. The fact is that not all brokers provide the ability to connect providers to a training account.

That is why it is not possible to test ideas with zero risk in social trading. It is possible to minimize possible losses by opening a cent account.

Trading signal providers

We have already described that signals can be generated both by professional market participants and by special programs. In both cases, the market situation is analyzed, a forecast is made, and a brief recommendation is given to clients.

Here is a list of some providers who are popular among many traders.

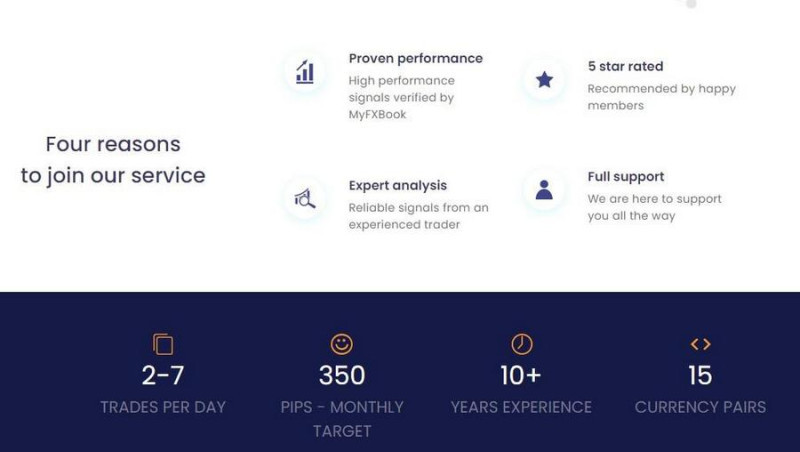

1. 1000pip Builder is a paid platform that sends two to seven signals per day to its users. The platform is managed by professional trader Bob James;

2. ForexSignals.com is a platform that not only provides clients with trading advice but is also a platform for communication. Traders can ask questions to mentors and share their trading ideas.

During the first week, the services of ForexSignals.com can be used for free;

3. Learn 2 Trade is an online platform that sends at least three Forex ideas per day. The Telegram channel of the same name is used as a channel for communicating with clients.

To become a member of the community, you need to pay for a subscription;

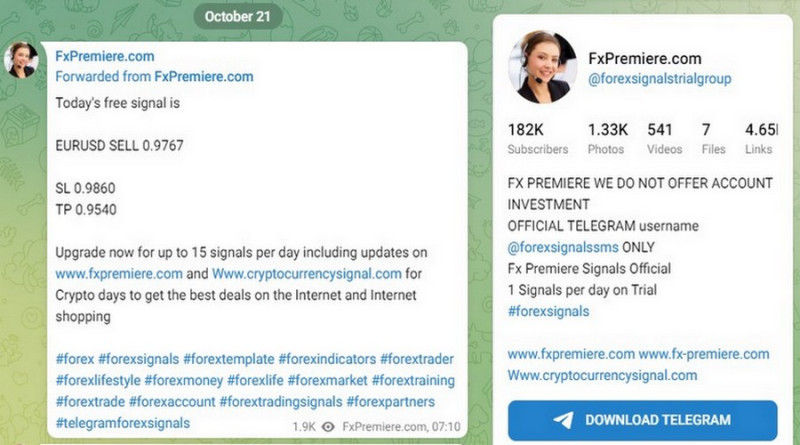

4. FX Premiere.com is a platform that can provide recommendations for more than 50 assets. A limited number of signals can be received for free by joining the FX Premiere.com Telegram channel;

5. eToro is one of the world's largest social trading platforms. The service allows users to copy trades made by experts, thereby using advice from professionals in their work.

Notably, many brokers offer the author's advice to the clients, which also can be used in trading. In addition, brokerage companies can recommend third-party providers who will assist in trading and provide ready-made ideas.

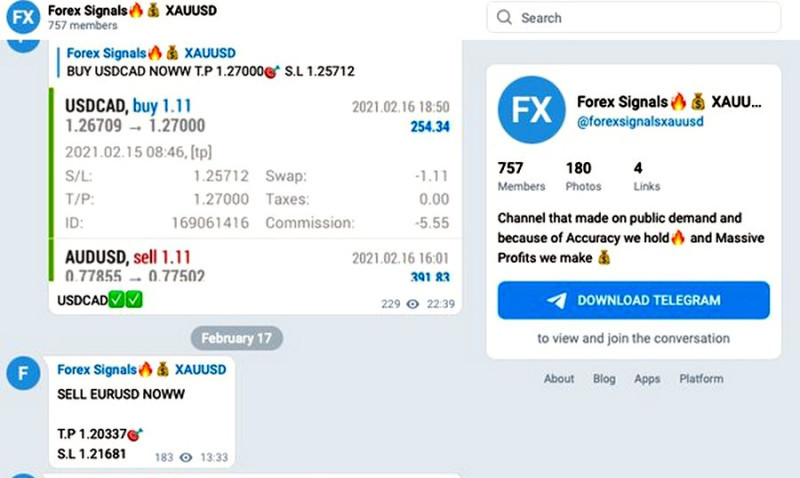

Trading signals on Telegram

We have already talked about the fact that you can receive trading signals through messengers. The most popular in this regard is Telegram.

When choosing a recommendation provider in this messenger, you should be guided by the following criteria:

- The experience of the provider: the more experience the provider has, the better;

- Feedback from other users;

- Availability of a free option for testing (if the ideas are paid);

- Statistics: effectiveness, the number of recommendations sent to users.

Some of the most reputable telegram channels are:

- FX Premiere.com. It has more than 180,000 subscribers, and sends up to 15 Forex signals a day, two of which can be received by free subscription. Recommendations are compiled not by the platform's specialists, but by third-party providers (there are more than 50 of them) based on concluded contracts;

- Free Signals Pro. This channel releases one recommendation per day absolutely for free. The number of Free Signals Pro subscribers exceeds 13,500;

- ForexSignals.io is one of the most popular channels. Its free and paid versions are used by almost 62,000 people in total;

- ApexBull is a free-of-charge channel with 43,000 subscribers, which provides users with financial news and sends out three ideas a day. It is not only about currency pairs but also about digital assets, indices, and metals;

- Sure Shot Forex. This provider not only provides five free trading signals a day but also reviews trades for its followers. The number of subscribers exceeds 21,000;

- AltSignals.io is a channel with 60,000 users, offering a paid subscription to its services. In addition to signals, it publishes detailed reviews of existing and past market situations;

- Learn 2 Trade. We have already mentioned this provider in this article;

- Forex Signals Street is a telegram channel that has more than 18,000 subscribers. Ideas in Forex Signals Street can be received free of charge or you can pay for the subscription for a period from one month to six months.

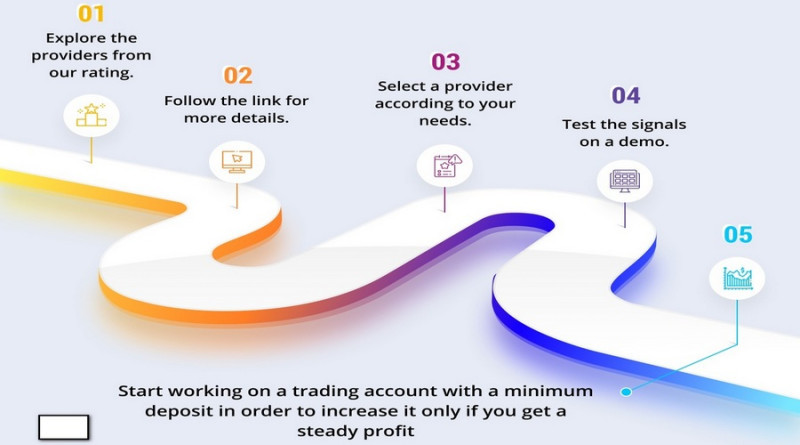

If you have already chosen a provider on Telegram, the following steps are required to start using them:

- Download and install the messenger application. It is more convenient than opening Telegram in your browser every time;

- Create an account if you do not have one yet. As a rule, it takes a few minutes to register an account;

- Subscribe to the provider, that is, a Telegram channel. The link can be found on the application's website or by entering its name in the messenger's search field;

- Turn on notifications so you do not miss important messages;

- Pay for a subscription, if it is a paid channel. Methods of payment are better to clarify in advance.

After that, you can use your recommendations in trading. However, it's important to remember to be quick when you apply them.

Even the most valuable and accurate trading advice loses its relevance over time, especially when it comes to short-term ideas.

Telegram has the following advantages:

- High speed of data transmission;

- No risk that the trading signal will drop into the spam folder. If you receive a signal by e-mail, it may happen;

- Security. The content of messages and all the data about users and securely protected.

Trading signals WhatsApp

If you prefer to use WhatsApp, there will be no problems with finding providers of trading ideas. There are many groups in the messenger that provide users with trading tips.

However, not all recommendations are effective in trading. This applies to both WhatsApp and other messengers.

The main features of reliable signals are:

- Quality, which is ensured by accuracy and potential profitability. Providers ensure the delivery of signals with an accuracy of at least 70%.

This means that the probability of financial losses is about 30%. Such figures are quite acceptable, but, as we have already told you, they are based only on historical data.

If a provider promises about 100% accuracy, you should think twice about using its recommendations. No signal can guarantee 100% profits;

- Feedback from other users. As a rule, providers have their websites, as well as groups in various social networks, where you can read traders' reviews.

If the provider only has a WhatsApp group, other users' opinions should be sought on forums. Another option is specialized review websites (e.g. Trustpilot.com);

- A number of subscribers. WhatsApp limits the maximum number of users in each group to 256 people.

Therefore, you should not be alarmed by the fact that not as many traders use the services in the WhatsApp community as in the Telegram channel. If the limit is exceeded, you will not be able to become a member of the group;

- Terms of refunds. There are situations when users join a trading signals WhatsApp group and pay for the services, but realize that trading signals are ineffective in trading.

For such cases, the provider should guarantee that the money will be returned to the user. At the same time, the latter will have to provide evidence that the advice was used correctly and promptly, but it did not lead to a winning trade;

- Free demo version. It is always good when you can become a group member for a few days or a week to evaluate the quality of signals without paying for the provider's services;

- No or minimal amount of ads. Sometimes other services and products are actively promoted in WhatsApp groups simultaneously with the delivery of ideas.

For example, it can promote brokers, indicators, strategies, etc. Such ads distract from trading, so there should be very few of them, and none at all.

To use trading signals WhatsApp, you need to download the application, create an account, and join the selected group.

Now let's briefly describe some of these communities.

- Forex King Club is a channel, which can also be found on Telegram. In the paid version, users receive not only Forex signals but also indications of potential risks and profits, as well as lists of attractive trading instruments;

- Trademasters is a free community where you can get trading tips from professionals. There are no promotional messages in the group, but it is not possible to join it at the moment, as the membership limit has been reached;

- FX Signals is a paid group for experienced players. The claimed accuracy of signals exceeds 80%. Participants receive about 30 signals per day, supplemented by fundamental factors;

- Forex GDP is a community for traders with different levels of skills and knowledge. Free and paid versions differ only in the number of tips per day;

- Ugaa Trading is a free group, whose members receive trading tips on Forex and useful educational content;

- Forex Trading World is a community focused on beginners. They promise at least one trading signal per day with the optimal time to make a trade.

How to use trading ideas received from messengers

Channels that can be used to get trading ideas do not differ much from each other. You can choose the most convenient one.

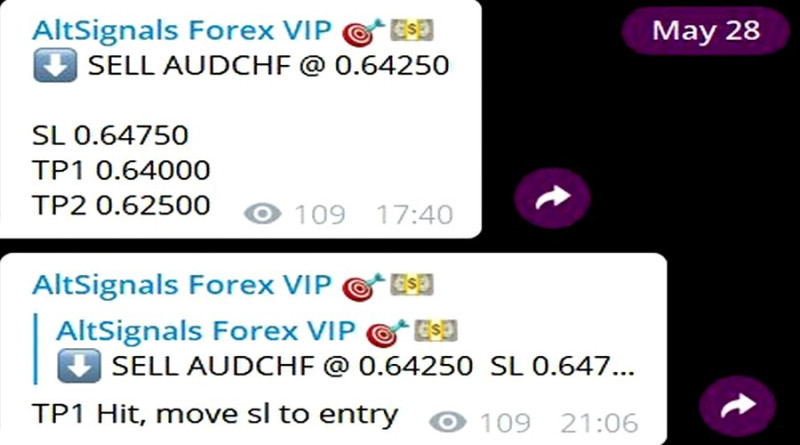

The screenshot shows an example of a signal received in one of the Telegram channels. It is a recommendation to sell the Australian dollar/Swiss franc pair.

The signal tells us to sell the asset at 0.64250. The recommended level for placing the Stop Loss order is 0.64750.

As for the Take Profit order, a trader is offered two options. This may come in handy if the user wants to close the trade partially or use the Trailing Stop order.

If a trader decides to use this trading idea from Telegram, they open a trade in their trading platform, determining its volume.

Recommendations from trading signals WhatsApp are also used in the same way.

Pros and cons of working with signals from messengers WhatsApp and Telegram

| Pros | Cons |

|

|

Thus, ready-made trading tips received from messengers can greatly facilitate and optimize your trading. In addition, trading becomes more comfortable and less stressful.

The main thing is to choose the right provider and manage your trading wisely. It is important to analyze incoming signals and treat them selectively.

Firstly, such an approach can hone your trading and analytical skills. Secondly, it will increase your responsibility for the performed trades.

MT4 trading signals

Signals received via Telegram, WhatsApp, and other communication channels should not just be studied, but used in trading promptly. We have already described that they lose their value over time.

Here everything is simple: the trader gets a signal in the messenger, opens the trading platform, and makes a transaction.

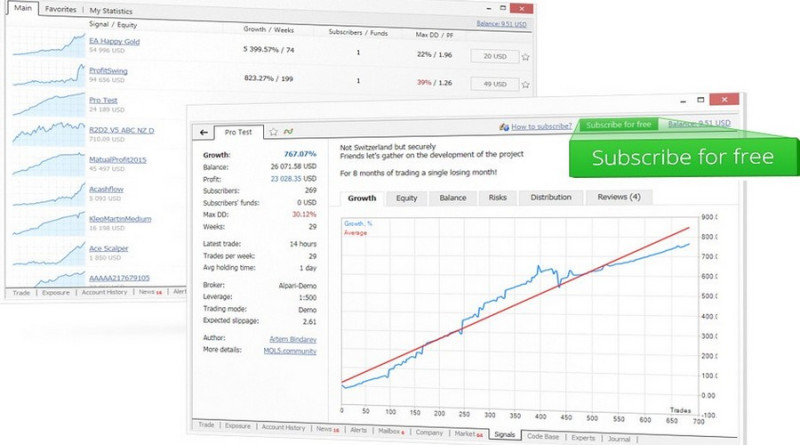

Trading signals can be received via a trading platform such as MetaTrader. Since the fourth version is the most common, let us explain how you can get trading tips on MT4.

Let us note that the signals in the messengers and MT4 signals are different. If you receive text messages in which it is recommended to make a purchase or sale, MT4 offers social trading.

In MT4, signals imply copying trades of other users. That is, the providers of recommendations are experienced traders who are willing to share their strategies with other MT4 users.

They can charge money for their services, or they can provide them free of charge - users can choose either option.

The list of all signals (there are over 3,000 of them) can be found in the section of the trading platform with the same name. The providers with the most outstanding trading results are the first on the list.

To start copying the trades of a particular trader, simply select it and subscribe to it.

How to start receiving signals in MetaTrader 4:

- Register in the MQL5 community. To do this, launch the platform, then in the Tools section go to Settings, and then to the Community tab;

- In the Terminal window go to Signals;

- In the drop-down list, study the list of providers. Using the filters, you can go through the available options according to different criteria;

- Click a particular supplier to get detailed information about his or her trading achievements;

- If you are satisfied with the terms, subscribe by clicking the appropriate button;

- Confirm the action by entering your password;

- Configure settings, if necessary. Here you can correct the size of possible investments (in percent of the deposit), set stop-loss orders, etc.;

- Confirm the settings.

If the service is paid, you will need to pay a subscription fee in advance.

The copying is automatic, that is, it does not require any additional actions. You can view the results in the Statistics tab.

If necessary, you can extend or cancel your subscription. You can do both via the trading platform or the MQL5 community.

Conclusion

To make a profit in trading signals WhatsApp, a trader should always be aware of important economic events as any missed news can lead to losses. In addition, traders need to take into account the data of technical analysis and follow the movement of quotes.

All this requires a lot of time and effort.

Trading signals can help improve trading results. They are important for all market participants - both beginners and professionals.

The value of such hints is not only in their contents but also in their promptness.

Despite all the advantages, a trader should not follow the received recommendations without any analysis. It is important to understand that they are just assistants, not orders to perform certain actions.

No matter how accurate and reliable the tip is, traders should make the final decision.

You may also like:

How to choose a broker for Forex trading

Trading tools

Best monitors for stock trading

Back to articles

Back to articles