Trading performance not only depends on the trader’s skills and knowledge, but also on the traded asset itself. This article will explain how to select and trade stocks in detail, as well as provide a list of the best stocks for novice traders.

If you would like to learn more about trading, read the article “What do you need for Forex trading” which provides the most important information for beginners.

Stocks and how they are traded at exchanges

First, let us have a look at what stocks actually are and how they are traded.

Stocks are a type of security issued by companies alongside bonds, promissory notes, and others.

In the past, stocks took the form of stock certificates with stamped seals and watermarks. Now, they are completely digital and are not printed out, with actual physical stock certificates being quite rare.

However, even though stocks largely exist only in digital form, they are still subject to strict reporting rules. Depositories, trustees, and registrars ensue stock transactions are carried out in accordance with these regulations.

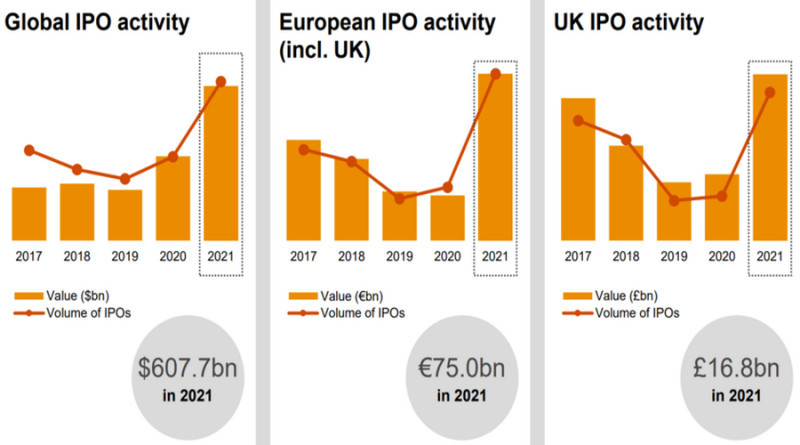

These assets are traded on stock exchanges. Stocks are listed on exchanges after the company passes a certain registration procedure. During the initial public offering, or IPO, the stock is offered to traders for the first time, with the issuing company setting its initial price.

When companies go public, they do it for several reasons:

- Raising additional funds for developing the company, such as funding purchases of new equipment, expanding production, etc.

- Estimating market capitalization, the value of all stocks in circulation. Market cap is also an estimate of the total value of the business or any of its parts.

- Allowing owners and stakeholders to sell their stake in the company at market prices.

As noted earlier, the company must pass a registration procedure to be listed on the exchange. It must present several documents and fit certain criteria, such as regularly releasing financial statements, operating for several years, practicing corporate governance, etc.

Exchanges have several listing requirement sets with different demands for companies.

Among other requirements, the company going public must fit these demands:

- The company must not be unprofitable.

- The company must not be involved in tax evasion; it also should not have past-due taxes or insurance payments.

- The company must pass an audit of financial statements.

- The company must have a business plan.

Furthermore, the listed company must pay the exchange’s initial listing fee. Overall, going public is an expensive process that often costs the company hundreds of thousands or even millions of dollars.

Following the IPO, company shares are then bought and sold by regular traders in the secondary market.

Benefits for shareholders

There are a number of reasons for private investors to buy shares of publicly traded companies.

- Holders can make a profit by buying the asset at a low price and selling it high. Buying and selling in a short period of time is referred to as trading. Investors, on the other hand, buy shares to hold them in the long term.

Besides actual shares, contracts for difference (CFDs) can also be traded. CFDs are derivative financial instruments that may bring even higher profits if traded properly. - Shareholders can earn dividends from the company. Stock dividends are paid out every quarter, 6 months, annually, etc. Different companies have different policies regarding dividend payments.

Dividends are only paid out when the company is profitable at the end of the accounting period. Furthermore, dividend payments must be approved by a shareholders' meeting. Occasionally, the company can divert dividend payments to expanding the business or funding innovative projects. This means shareholders are not guaranteed to get dividends if they own a stake in the company. - Shareholders can vote on key management decisions in the company. However, not every equity can grant its owner the right to do so.

Overall, stocks are a versatile instrument that offer both cash gains and intangible benefits. Therefore, investing in these assets always remains relevant.

Trading shares for beginners: CFDs

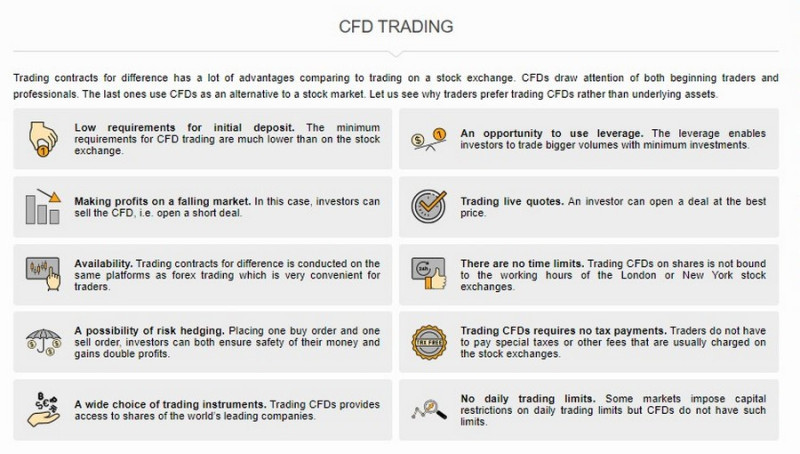

As noted earlier, market participants can also trade contracts for difference or CFDs. A CFD holder does not own the actual asset and is thus ineligible for dividend payments.

However, since CFDs are derivative financial instruments, they can be traded on margin, which may boost potential profits.

For example, a trader may have a deposit of only $10. With a leverage of 1:200, they will increase their capital 200-fold. However, this increases potential risks as well.

How are CFDs traded?

Step №1: a trader opens a brokerage account at a company that offers CFDs.

Step №2: the user downloads and installs one of the offered trading platforms.

Step №3: the trader tops up the account and chooses a trading instrument.

Step №4: the trader opens a long position if they believe the stock will go up, or a short position if the stock is expected to decline.

Step №5: the trader closes the position. If their expectations are correct, the trade will be profitable. CFD trading is generally carried out intraday during a single trading session.

CFD trading has the following features:

- You can earn on both rising and falling market, something that is impossible when trading actual stocks.

- Using leverage allows traders to maximize their potential gains.

- CFDs can also be used for risk hedging. For example, a shareholder expecting the stock to drop in the short term may use CFDs to open a short position and limit risks.

Types of stocks

Stocks are generally divided into common stocks and preferred stocks. Most traded securities in the stock market are common stocks.

Here are the main characteristics of common stocks:

- Stakeholders have voting rights, allowing them to influence the company’s development. Usually, but not always, one share equals one vote at a shareholders’ meeting.

- Dividend payments are not guaranteed, and their size is not specified in the company’s documents.

Preferred stocks, on the other hand, have the following characteristics:

- Dividend payments are often clearly specified and guaranteed.

- Shareholders do not have voting rights. Some companies do offer them voting rights in exchange for giving up the right to earn dividends.

- Preferred shareholders get repaid first if the company dissolves or enters bankruptcy.

Depending on the reliability of the asset, company stocks are also divided by traders into the following categories:

1. Blue-chip stocks are the most desirable securities. They are issued by large companies that are financially stable and offer their holders stable and sizeable dividends.

Several examples of blue-chip stocks are companies like McDonald’s, Visa, Procter & Gamble, etc.

2. Penny stocks are equities that typically trade for less than $5 per share. They are traded by market participants with small capital. Penny stocks are highly volatile, and their performance can be very unpredictable.

Some examples of penny stocks are Avon, HTG, and others.

3. Growth stocks are equities of companies with significant growth potential and are generally bought by long-term investors.

4. Income stocks offer their holders large, stable dividend payments.

5. Value stocks are relatively cheap equities, often issued by little known companies.

6. Speculative stocks are issued by companies with a high Dow Jones score. Market participants can earn on their price fluctuations, which are frequently influenced by outlooks.

Furthermore, stocks can be divided based on who can buy them:

- Stocks of private companies are not sold on stock exchanges and are offered to a limited number of people, such as their founders.

- Conversely, stocks of public companies can be bought and sold by anyone via stock exchanges.

Some stocks offer their holders full or limited voting rights at shareholders’ meetings, while others do not.

Companies issuing securities offer registered and bearer financial instruments. Information about the owners of registered instruments is recorded by the issuing firm. These instruments cannot be sold or gifted without the endorsement of the issuer.

Bearer instruments, on the other hand, are presumed to be owned by the person holding the security, which are not registered by the issuer. Such securities can be bought and sold without notifying the issuing company.

The issuing company’s website provides information on what types of stock it offers for sale.

Price factors

As stated earlier, traders can make a profit on fluctuations of asset prices. Here are the main factors influencing the price of a security:

1. Changes in the company’s financial position. Publicly traded companies regularly publish financial statements, which are released to the public every 3 or 6 months.

The most important factor considered by the market is the ratio between profits and losses within the accounting period. If the company’s net profits rise, its share price increases as well, and vice versa.

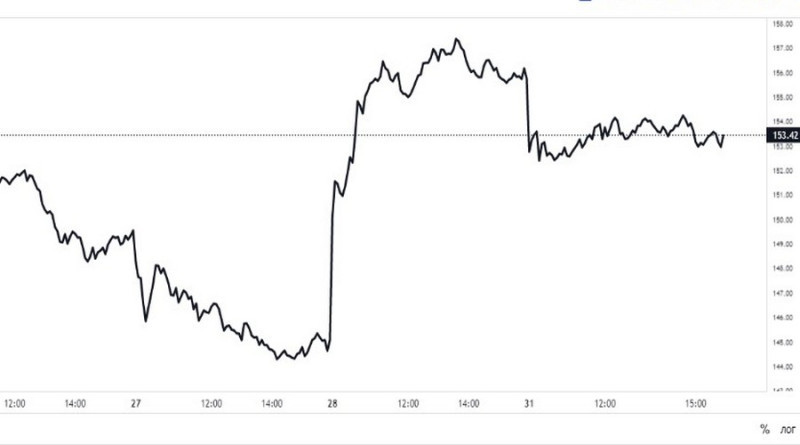

For example, shares of Apple jumped by 7.5% over a single day in late October 2022 after the latest quarterly report showed the corporation’s earnings climbed by 8.1%. It was the biggest intraday increase since spring 2020.

2. State of the economy. The situation in the national economy is a key factor for a company operating there. If the economy expands, stocks, particularly those within rapidly developing sectors, climb as well.

3. Political events: elections, conflicts, international diplomacy. Trade conflicts between different countries always have a negative effect on the financial situation of companies.

4. Supply and demand for products and services of issuing companies. Rising demand boosts the company’s share price, and vice versa.

5. Market sentiment. Traders may buy company stock or dump it based on information about the company’s competitors, among other reasons.

Trading strategies

Traders wishing to make a profit must have a clear and effective strategy, which is a set of rules created and followed by a market participant.

Trading strategies explain what traders should do in different market situations.

There are many trading strategies available, and every trader chooses the strategy that fits their financial goals and personal traits.

Some common classifications of trading strategy types can be found in the table below:

| Criteria | Type | Brief description |

| Trading period | Short-term, medium-term, long-term strategies | Short-term strategies involve making trades intraday, while medium- and long-term strategies involve investing into an asset for several months or even years. |

| Level of risk | Conservative strategies, medium- and high-risk strategies | The former strategies do not accept very high risks, while the latter employ aggressive trading tactics. |

| Market trends | Bullish and bearish strategies | Bullish strategies are used during an uptrend, while bearish ones are employed in time of downturn. |

Here are some trading strategies that can be used when trading securities:

- News trading strategy. Traders using this strategy analyze the latest news and events and predict their impact on the market.

This strategy demands swift decision-making, as the market reacts very quickly to the news. Furthermore, in certain cases, the reaction can be muted if market participants have already priced in the event before. - Intraday strategy. This strategy is the one that is frequently used for trading CFDs. It allows traders to make a profit even from minor price fluctuations.

Usually, intraday traders employ technical analysis tools, particularly price charts, support and resistance levels, and trend lines. - Swing trading. Traders employing swing trading try to go long on the asset right before an uptrend or sell the asset before it reverses downwards.

Technical analysis indicators are used by market participants to detect potential trend reversals and find optimal market entry and exit points. - Trend trading. This tactic is used to capture gains from the predominant market trend. Traders go short on the asset during a bearish trend and open long positions during a bullish one.

Technical analysis tools are used to determine the ongoing market trend. - Scalping involves executing trades in a short period of time. Each of them can take from several minutes to several hours, so scalping is considered to be a high-frequency trading strategy. Generally, each trade does not bring much profit, but scalping can bring impressive results since the number of transactions is large. However, traders must constantly monitor the situation and make quick decisions, which is a big disadvantage of such a strategy.

- Position trading. Traders using this strategy hold open positions for a long time, sometimes for several years. They aim to make a profit in the long term.

When making trading decisions, position traders look at fundamental factors such as the issuer’s financial position, and not technical analysis.

You can try out different strategies by using a demo account. By registering a demo account with InstaForex, you can begin trading CFDs with minimal financial risks.

How to choose stocks for trading

Some novice traders believe that choosing the right stock for trading is easy. You just need to compare financial statements of major companies and select the best-performing one.

However, this is a misconception.

Share prices can go down even if the company is performing well. Furthermore, the market is reacting to expectations, and not the past performance of companies.

For that reason, you will need to do the following when selecting the right asset:

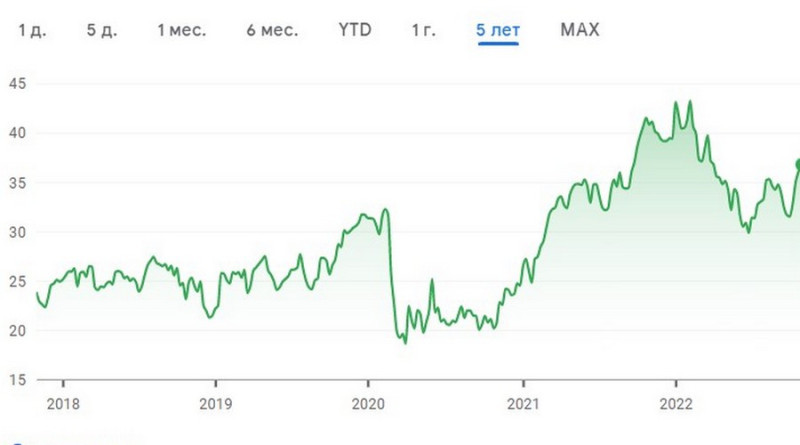

- Evaluate the financial situation of the company over time: for example, compare financial statements and presented data over the past three to five years.

- Take note of existing forecasts. Some companies with good potential do not show impressive results when they start out, but they still have a good chance of success.

- Examine the situation in the industry. For example, if the construction industry is in decline, any uptrend of construction stocks will be unlikely.

- Analyze liquidity: if it is high, then the security is actively traded and can be quickly sold at a market price. You can check the level of liquidity by analyzing trading volumes or the spread (the lower it is, the higher the liquidity).

Another important thing to note is that some securities are less sensitive to negative market conditions than the others. These securities are suitable for long-term investors who want to keep their portfolios stable.

Such assets include:

- Shares of public utilities, fast food, and transportation companies. People will always use their services, so these securities will be the least affected in times of crisis. These assets have low volatility, which is why they are not a great choice for short-term traders and scalpers. However, they are the right asset for investors who want to make a small but stable profit over the course of several years.

- High-yield securities and shares of industrial companies.

As for short-term traders, the most attractive securities for them are growth stocks, issued by companies with great potential. Such companies actively expand the geographical reach of their services, optimize their business, and implement new technologies.

These securities quickly recover when they dip due to negative market trends.

When choosing stocks, an investor should consider not only the company's performance, but also the trading goals, as well as the strategy's time frame. Ideally, the best stock would be a security that is in demand among other market participants and that also meets the trader's expectations.

Stocks for beginner traders

There is a great variety of stocks available for trading in the market.

Out of the many publicly listed companies, traders can choose the one which is more likely to bring them profits.

However, many beginner traders can easily get overwhelmed by the number of traded securities.

Here are 5 stocks from various economic spheres that can be used by novice traders.

1. Bank of America is a US banking giant. Its stocks slumped in 2022, but analysts see the company’s share price increase in the long run. Long-term traders can take advantage of this. Bank of America also offers steady dividend payments to its shareholders.

2. Prologis Inc. is a US trust fund that invests in real estate, mainly in logistics. The company is actively acquiring new assets. It planned to finalize the deal to take over its rival, Duke Realty, by the end of 2022.

Rising rents are one of the key growth drivers for Prologis Inc.

3. Procter & Gamble is the world's leading multinational consumer products corporation. It has shown steady growth for many years in a row.

Despite poor sales figures in 2022, analysts predict sales will increase in the long term.

4. McDonald's is a corporation operating the world's largest fast food restaurant chain. In 2022, shares of McDonald's declined due to macroeconomic difficulties and the energy crisis in the eurozone.

However, the corporation's quarterly reports show that its financial position is gradually improving, which suggests an optimistic outlook for the stock.

5. UnitedHealth Group is an American healthcare company which operates a pharmacy network. In addition to providing medical services, the company is also providing insurance, counseling, and pharmaceutical distribution services.

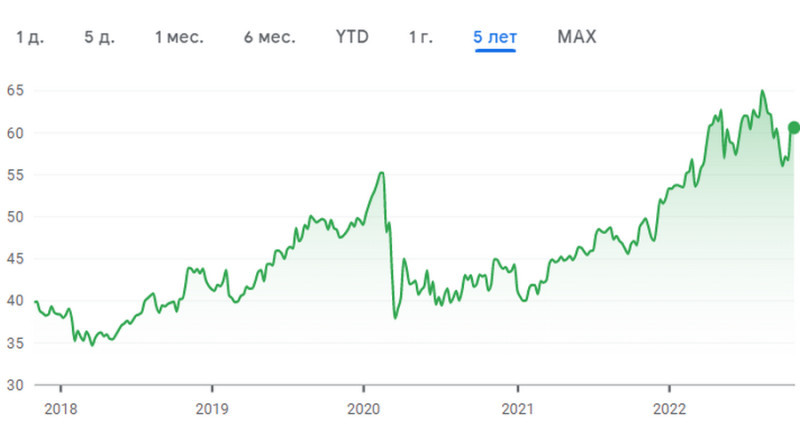

UnitedHealth Group stock is primarily attractive from a long-term investment standpoint, as its returns exceed those of the S&P 500.

Here are some current stock market trends to help you understand what's going on in the market:

- 2022 was not a good year for semiconductor manufacturers, such as Nvidia, Intel, Micron etc.

- Commodity stocks are currently on the rise. The energy sector is particularly promising, which is represented by stocks like Daqo New Energy, Cenovus Energy, and others.

- Chemical and pharmaceutical corporations are also climbing. Among them are Albemarle, Lantheus, and Pfizer.

- Companies manufacturing consumer goods and providing services have not lost ground. Examples include Coca-Cola, McDonald's, and Adidas.

Avoiding mistakes

There are certain rules that must be followed to ensure that stock trading is not only psychologically satisfying, but also profitable. They apply to both trading shares for beginners and experienced traders.

Such rules will help traders avoid mistakes and disappointment, as well as prevent massive losses.

Here are the most important ones:

- Every trader, even a professional one, must have a plan. No matter what stocks a market participant trades in and what profit they expect, every single move must be carefully planned, and all contingencies must be considered.

- Use tools that optimize your trading and make it easier. Analytical platforms, calculators, indicators – all these tools were developed to make your trading more convenient and efficient.

- Do not trade against the trend, especially when you are starting out. For example, if an asset is getting cheaper, it is very risky to buy it without being sure that it will reverse upward.

- Use different types of orders. Market orders are executed immediately at current prices.

Pending orders are triggered when the price reaches a pre-set level. Experts say that it is very risky to use only market orders when you are new to trading.

- Do not miss important economic events and follow any news that might affect the market. Even if you do not employ news trading strategies, this information will help you plan your trades properly.

- Remember that greed and fear are your greatest obstacles on the path towards your goals. They make you deviate from your trading plan and make hasty and risky decisions.

- Even if your trades are consistently successful, you should always analyze your transactions, especially losing trades. Keep a special notebook and record both your successes and failures, as well as what caused them.

- Do not let emotions control your actions. If you feel that you cannot handle them, take a break from trading, at least for a while.

- Proceed with caution when using leverage, especially if it exceeds 1:500. You must be aware that transaction volume increases not only potential profits, but also risks.

- Do not start trading unprepared. Before entering the market, study price charts, check indicator signals, and consult the economic calendar. Such a comprehensive approach is important even if you only use technical or fundamental analysis to predict price movements.

- Do not be afraid to diversify your holdings. Do not assume that a company with a steady flow of profits will always remain profitable. To hedge against losing your money due to force of circumstances, it is advisable to spread your investments across several stocks.

It was already mentioned earlier that stocks are traded during the stock exchanges' trading hours. But what is the best time to trade stocks?

There is no definite answer to this question. Some experts recommend making transactions at the very beginning and at the very end of the trading session.

They claim that during these periods the liquidity and volatility is the highest. While this will surely make successful trades more profitable, beware that high volatility can lead to huge losses.

Conclusion

Trading shares for beginners can be a great way to earn extra money, and it can even become your main source of income. Securities are less susceptible to external factors than assets like fiat currencies or cryptocurrencies.

That makes fundamental analysis more effective for these assets.

Another advantage of securities is their high liquidity, especially in the case of CFDs. Generally, only marketable securities which are in high demand by market participants reach stock exchanges.

Information about their issuing companies can be easily found online. Any user can easily get full information about any of the issuers.

However, stocks can only be traded during the designated trading hours. Therefore, you need to check the business hours of the stock exchange.

The same principle usually applies to CFD trading as well.

You may also like:

How to choose a broker for Forex trading

Trading signals WhatsApp

Trading tools

Best monitors for stock trading

Back to articles

Back to articles