In the era of the Internet and globalization, it is challenging to remain detached from the global agenda. Our smartphones, tablets, and computers constantly chime with notifications, eager to inform us about the latest events in the world. Among the stream of news, messages about international corporate giants hold a special place. Today, some major company has signed a multi-billion-dollar contract, and yesterday, another one released a highly anticipated product into the market.

As we scroll through these notifications, many of us may wonder: why do I need to know all this? For instance, how can the launch of a new BMW product or another contract by Virgin Galactic Holdings affect my life? After all, I prefer Japanese cars, and I've never been interested in space travel.

However, don't rush to unsubscribe from such newsfeeds. In some cases, this information can be extremely useful and important for you. One of those cases could be the decision to invest in the securities of large global companies.

This is precisely how you can easily tap into the success of international corporate giants in the modern world. Today, by simply buying a single share of Microsoft, Apple, or Pfizer, each of us can become a part of the history of these global giants.

By the way, we provided detailed information about the investment in shares process in our article "Investing for Beginners" where we thoroughly explained the steps for your initial investments, choosing the ideal investment object that suits you, and methods to earn the long-awaited profit.

However, let's focus on investments in securities. We've already mentioned that by investing in the stocks of a popular corporation, you become a part of it. And its future success automatically becomes yours as well. All of this is undoubtedly very pleasing, but it is important to remember the most crucial aspect – profits!

Every time your successful company makes a profit, you make one too! However, let's be honest: even the most successful companies have their black days and challenging periods. And that is when investors share the ups and downs of their chosen investment objects.

This is why today we will delve into how profitable it is to invest in stocks and how significant the associated risks can be.

Key aspects of investing in stocks

Before we delve into the specifics and rules of investing in this field, let's thoroughly understand what exactly falls under the concept of stocks.

So, a stock is a financial instrument issued by companies, known as issuers. In essence, when an organization needs additional funding for its operations or new projects, it starts selling its financial instruments.

To do this, it needs to become a public company, divide its capital into small parts (stocks), and begin offering them to interested parties.

In turn, interested parties can acquire these financial instruments in two ways: on a stock exchange or outside of it.

Speaking of the pros and cons of these options, the first one generally prevails. The reason is that trading on exchanges is relatively transparent and safe, as the value of financial instruments can be easily tracked. In the case of buying or selling securities outside the exchange, there is an increased risk of overvaluation or undervaluation compared to the market value.

Furthermore, each stock exchange rigorously assesses the issuing company's safety. Given the seriousness of such checks, it is hard to imagine that assets of obvious fraudsters would make their way onto these exchanges.

When an investor purchases a company's financial instrument, they not only become a part of its business but also enjoy various attractive perks:

- The right to receive dividends.

- The opportunity to vote at shareholders' meetings, participate in the company's management, and influence important decisions.

- The right to claim a portion of the company's assets in case of its liquidation.

Sounds enticing, doesn't it? Many of you may have already envisioned yourselves owning shares of your favorite company, holding beautiful documents with the company's logo and detailed information about your ownership.

However, we hasten to disappoint you: stocks don't quite look like that. In fact, they don't look like anything at all. The reason is that they exist solely in electronic form.

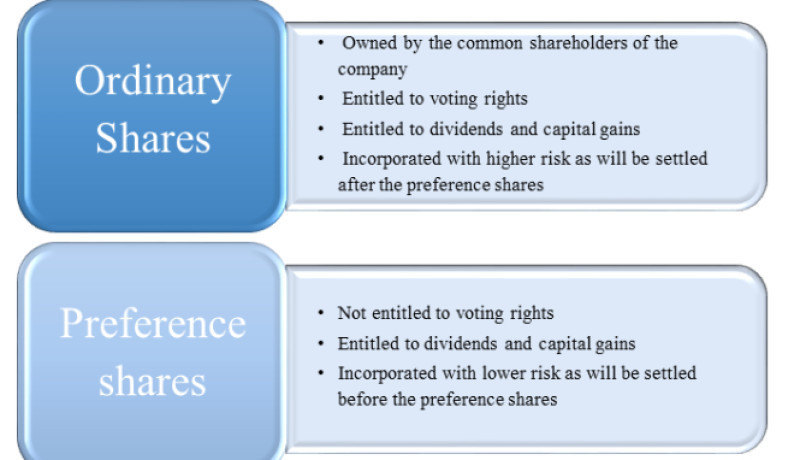

But just because these assets are non-documentary doesn't mean they lack significant characteristics and features. There are two main types of securities: common (CA) and preferred (PA).

The key distinction between these two categories lies in two points: the right to vote and the receipt of income in the form of dividends. These aspects are available for review by holders of securities in the company's Charter.

It is important to note that a single company can issue both of these categories of shares. However, it is worth mentioning that by law, the number of preferred shares cannot exceed 25% of all securities issued by the company.

As a result, the majority of securities fall into the common category. Their holders have the right to vote at shareholders' meetings but may not always count on dividends, only receiving them in case of a positive decision by the general meeting. Even a stable company profit doesn't guarantee that holders of common shares will receive payouts.

Meanwhile, owners of preferred shares are guaranteed dividends at all times, and their minimum amount is specified in the documents of the joint-stock company. The only reason dividends may not be paid is the absence of profit.

Owners of preferred shares have a predetermined amount of payouts. Most often, this is a percentage of the company's annual profit divided by the number of preferred shares. Less frequently, a fixed amount or a percentage of the nominal value of the securities is paid as dividends. The procedure and rules for calculating payouts are specified in the Charter of the joint-stock company.

When the shareholders' meeting decides to allocate part of the organization's profit for dividend payments, holders of preferred shares will be the first to receive them, and only after them, holders of common shares. After dividends are calculated and distributed among shareholders, all categories of securities holders receive their payouts simultaneously.

It is important to note that another significant bonus for preferred investors is the opportunity to be the first to purchase securities from a new issue.

As for the right to vote, owners of this type of shares are deprived of it. They can only exercise their voting rights if they haven't received dividends for the past year. In that case, preferred shareholders obtain the same rights as common shareholders at the next meeting, allowing them to vote on all matters. This situation persists until the full payment of dividends to holders of preferred shares.

They also gain voting rights in the event of a company's liquidation. Additionally, holders of preferred shares have a priority right to receive a portion of the assets of the joint-stock company in case of its liquidation.

Even after a detailed analysis of common and preferred shares, it is difficult to say which type of securities is better. Most likely, the choice remains with each individual investor.

For those who want a stable guaranteed income, it is better to choose preferred securities. And for those who want to be constantly involved in all processes and decisions of the chosen company, common shares are more suitable.

Speaking of the statistics of stockholders worldwide, the majority of them opt for common shares. The reason is high liquidity. Most investors view investing in stocks as a profitable business investment in shares rather than an opportunity to receive dividend income.

*Issuer company: An organization that registers and issues securities to finance and further develop its activities.

*Dividends: A portion of the profit of a joint-stock company distributed among holders of its securities according to the number and type of shares.

*Liquidity: The ability to quickly and easily sell a trading asset at a price close to the market value.

What influences the price of stocks?

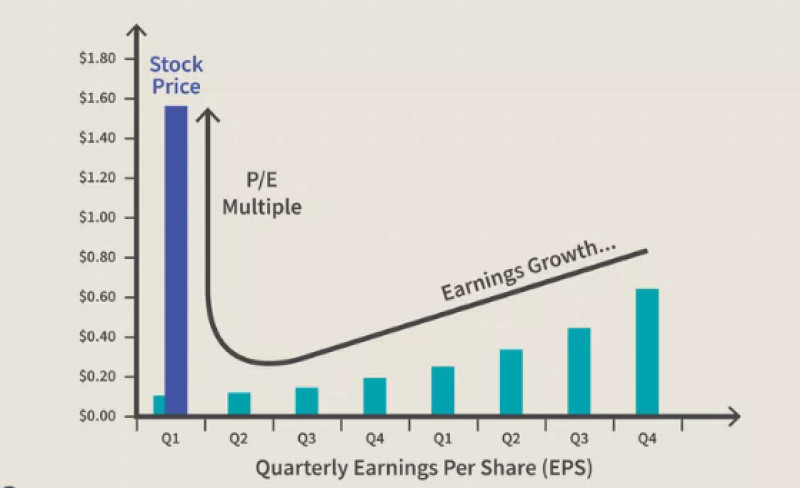

Let's start with the fact that every security has a nominal and market value. Despite the investor's primary interest in the market price of the asset, to have a clear understanding of its formation, it's necessary to first understand the nominal value.

After the owners of the company register it as a joint-stock company, they conduct the issuance of securities. This process includes determining the authorized capital of the organization (the amount it operates with) and the number of shares. As a result, each security of the company becomes a percentage (share) of its capital.

Based on this, when forming the nominal value of securities, their quantity and the organization's capital are taken into account. The initial investors of the company buy shares at this initial price. Then, the rules of the market come into play, and the price of the securities begins to change constantly.

After the issuance, shares are listed on stock exchanges. Their owners have the right to declare a price that does not coincide with the nominal value. From this moment, the formation of the market value begins. Unlike the constant initial value, the market value fluctuates continuously.

The current price of stocks in the stock market is called a quote. Changes in quotes depend on the demand and supply of investors, as well as their forecasts and expectations.

If a potential investor believes in the company's future prospects and considers it undervalued compared to competitors, they buy its securities, expecting to profit from their future rise. Another incentive to buy assets can be the expectation of strong profit reports and announcements of significant dividends.

The further scheme looks extremely simple: in the face of increasing demand, the price of stocks rises actively. However, there can also be a reverse situation: when investors are convinced that the company is significantly overvalued or is on the brink of potential business risk, they begin to sell its assets hastily.

It may seem that all of this is so simple and accessible that even a child can make a profit on stock exchanges without effort. Unfortunately, in modern market conditions, this process appears much more complex. The reason for this lies in the numerous factors constantly influencing the price of securities. Next, we will discuss each of them in more detail.

Company’s performance

First and foremost, this includes the profit of the joint-stock company. Additionally, it is important to consider the prospects for dividend growth and improvement in the dividend policy, plans to conquer new sales markets, the possibility of concluding profitable contracts, and the emergence of new investment in shares programs.

The better these indicators are, the higher the return on the organization's securities. This means that shareholders can expect good dividends in the future. Consequently, the quotes of such assets will confidently rise.

Also, among this group of factors, the company's reputation occupies a significant place. If both the society and market participants trust the organization and consider it reliable, its assets steadily increase in value. Conversely, securities of a joint-stock company with a poor reputation are not popular among investors, resulting in a decrease in their value.

Lastly, a significant impact on the stock price is the ratio of its reliability and profitability. The greater the risk and the higher the fluctuations in quotes, the more attractive the potential returns for investors. However, investors worldwide prefer to buy more stable assets with a modest return.

Changes in the company and industry

Every event related to the company and beyond its boundaries inevitably affects its stock quotes. This can include the introduction of new products to the market, the conclusion of significant contracts, product recalls, changes in leadership, and so on. Additionally, asset values depend on industry news, i.e., changes occurring in a particular market.

For example, if the company chosen by an investor belongs to the automotive sector, they need to carefully monitor everything happening in this business sector.

Any changes in legislation, imports and exports, tariffs, the cost of spare parts and raw materials, immediately affect the organization's activities and, subsequently, the price of its shares. By reacting wisely and quickly, holders of securities can profitably sell or buy them.

State regulation of the industry is also an important point here: regulatory barriers or the creation of favorable conditions to stimulate the development of organizations.

For instance, if the government increases tariffs on electricity, companies in the energy sector significantly increase their revenues and, thanks to this, can implement new investment in shares programs.

- Political situation

Political news in a particular country also significantly affects the stock price of a company registered there. Rating agencies assign a rating to each country.

If a country experiences a stable political and economic situation, it receives a high rating. Seeing this, investors confidently invest their money in joint-stock companies of that country. If the situation in the country deteriorates (due to changes in power, protests, strikes, sanctions), rating agencies immediately lower the rating.

For example, negative news about the deterioration of the political situation in the UK can exert significant pressure on the shares of giant corporations such as Barclays, Tesco, or Vodafone Group, while positive news can lead to their growth.

In times of instability in one country, investors choose to stop investing in the stocks of companies in that country and invest in assets from another. As this phenomenon becomes widespread, the stock prices of companies in the hypothetical UK can sharply decline.

- Economic situation

First and foremost, this includes the financial policy of a country. The long-term dynamics of securities are significantly influenced by the growth rate of the gross domestic product and the increase in real disposable income of the population.

Another important element is the key interest rate of the central bank of the country. The reference rate is the main instrument used by a country to regulate its financial policy.

If we try to imagine the relationship between the stock market and the key interest rate of the central bank of an individual country separately, it would look like this: when the rate increases, the growth of securities decreases, and when the rate decreases, the attractiveness of stocks increases, along with their price.

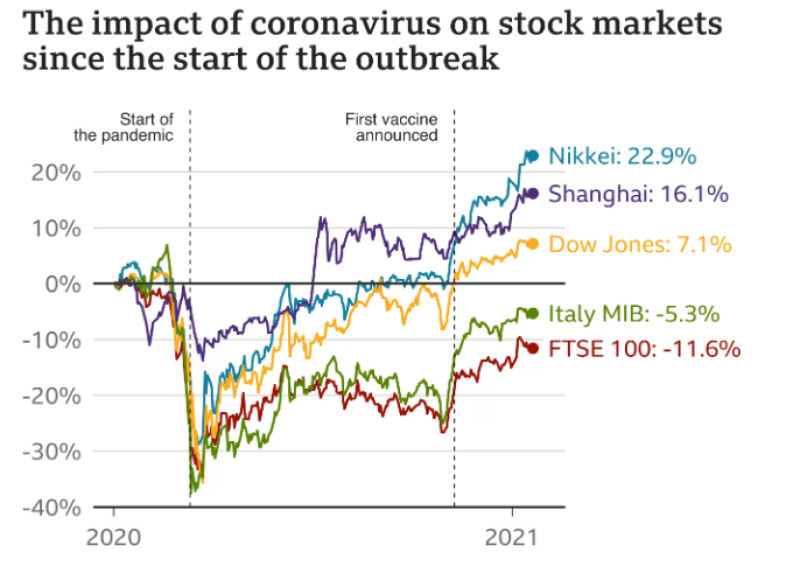

- Force majeure events

Major accidents, pandemics, armed conflicts, climate disasters, natural catastrophes, and "black swan" events fall into this category. For companies in one industry, these events can be a real disaster, while for organizations in another, they can be an opportunity for a sudden leap forward.

For example, due to the COVID-19 pandemic, companies in the tourism and aviation sectors suffered significantly. The businesses of these organizations recorded significant losses, and many companies in the industry were forced to declare bankruptcy.

Meanwhile, corporations in the internet commerce, pharmaceutical, and computer gaming sectors reported record profits during that period. For instance, the securities of Zoom, whose popularity surged due to the widespread transition to remote work, soared by nearly 500% in 2021.

Taking into account everything mentioned above, it becomes clear that the stock price is influenced by multiple factors. It is impossible to predict, let alone plan for, the long-term perspective of stock prices. Neither last year's quotes nor extensive experience in investing and trading can help in this regard.

The only way out is constant analysis of all the factors mentioned above and seeking recommendations from market analysts, economists, and experts from brokerage companies.

*Black Swan: This is a market term that entered common use in 2007. It was formulated by the American writer, Nassim Nicholas Taleb. It refers to unplanned, sudden, and rare geopolitical or social catastrophes that have significant consequences for the entire world.

Investment in shares risks

Despite the fact that investing in stocks can be a profitable endeavor, it is important to remember that it comes with multiple risks. Furthermore, these risks are proportionate to the potential return on the stocks: the more you can earn from stocks, the higher the risks for their owners.

One of these risks is associated with receiving dividends. Many investors are accustomed to the following scheme: at the end of the year, the joint-stock company makes a profit, the general assembly decides to distribute it among the shareholders, and the holders of the stocks receive dividends for each of them.

However, no one guarantees such a scheme. It happens that the organization operates at a loss. There are also cases where the management decides not to distribute the profit among the shareholders but to allocate it for further business development. The possibility of such a risk always exists.

Another common risk for investors is related to the rise in the value of stocks. When a market participant invests their capital in assets, they expect that in the short or long term, their value will increase. Later, the investor can sell them and gain a profit from the difference between the purchase and sale prices.

This may seem like an ideal scenario, but in the harsh reality, it can turn out differently. Stockholders can lose a significant amount of money if the stock prices fall. Everything is determined by the law of supply and demand.

Investors often face credit risks related to the potential bankruptcy of the issuing company. In such a case, the stocks sharply depreciate. However, there is one important compensating factor in this situation. Owners of such stocks can expect a share in the assets of the joint-stock company upon completion of the bankruptcy procedure.

Lastly, one of the potential risks for holders of such assets is the danger of freezing foreign stocks abroad due to sanctions. In such a situation, stockholders will not be able to sell them and receive dividends.

Conclusion

One of the significant advantages of investing in company stocks is the possibility of obtaining a high income. Sometimes the profits from such investments far exceed the earnings from other trading instruments.

However, investments in stocks always come with serious risks, and therefore, this option is more suitable for those who have a financial safety net and are not using their last funds to purchase stocks.

This is why, before investing capital in stock exchanges, we recommend that you fully assess all risks and prepare a reliable fallback plan.

Never forget the direct relationship between returns and risks. If some stocks have sharply increased in value, it means that they can just as quickly plummet.

Also, remember the importance of diversifying your investment in shares portfolio. Do not invest everything in the stocks of a single company; choose several suitable organizations, preferably from different business sectors.

And always keep an eye on market events. Study, observe, analyze, and earn!

You may like:

Back to articles

Back to articles