People beyond the financial world are well aware that just storing money in a piggy bank is unfashionable, unwise, and unprofitable. Money hidden somewhere at home quickly loses in value. Investors have always stuck to the motto "Money should work for you!"

No doubt, money should bring its owner passive income annually, monthly, or even better, daily. In other words, we are all encouraged to invest and learn how to allocate funds in a way that yields maximum profit. However, the decision to put one's money to work, even though it promises good returns, is a rather challenging and responsible step for someone who has always had their money readily available.

In the article 'Investing for Beginners', we discussed in detail and in a simple language the process of investing. The article delves into the stages of initial investments, choosing the perfect investment asset for you, and the ways to earn the long-awaited profit.

Motivated by this push, we hope you have started searching for profitable investment opportunities for your savings. Today, there are numerous options available, but we will try to highlight the main categories:

- securities

- bank deposits

- currency exchange differences

- precious metals

- bonds

- mutual funds

- futures

- startups

- cryptocurrency

- investment platforms

- residential and commercial real estate

Each of these investment methods has its advantages and disadvantages, deserving of many articles. However, today we will focus more on the last item on our list – investing in residential and commercial real estate.

*Passive income refers to funds that are received by an investor as interest from profits.

Investing in real estate: key aspects

Before expanding on the features and rules of investing in this business sector, it is crucial to understand what exactly real estate represents. Legally, the following properties are recognized as real estate: land plots, subsoil plots, as well as buildings, premises, and unfinished construction projects located on them.

There are four key characteristics that qualify a property as real estate: immobility, durability, a strong connection to and dependence on the land, and high value. Thus, real estate typically refers to physical objects that cannot be moved without damaging or losing their essential functions.

Consequently, real estate investment involves the purchase, management, leasing, or selling of real estate properties with the aim of making a profit. The individual who invests funds in this sector, either actively or passively, is known as a real estate investor. Importantly, such investment is a sophisticated and costly business requiring fundamental knowledge and experience in the field.

Regarding the key aspects of investing in real estate properties, the following are highlighted:

Wise selection of real estate properties. Before deciding on this type of investment, it is essential to thoroughly study and analyze the real estate market. Compare prices, explore options, and assess the demand for the property.

• Finding the optimal source of funding for the investment project. It is important to consider as many financing methods as possible: bank loans, investment funds, mortgages, etc.

• Clear definition of investment goals. Decide in advance what profit you aim to achieve and in what timeframe.

• Detailed consideration of risks. Venturing into real estate investment, you should understand that it, like any other, always accompanied by some risks. Try to calculate all potential risks associated with investing in this business area and take measures to minimize them.

Investing in residential vs. commercial real estate

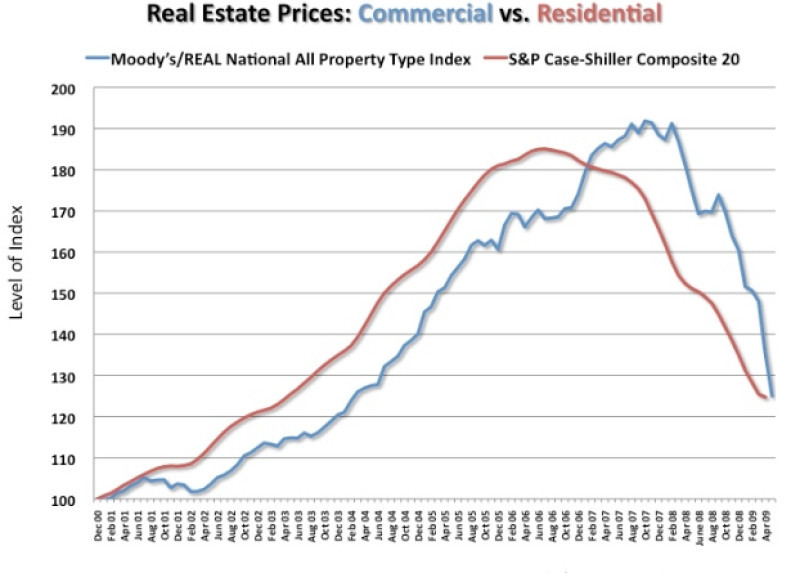

Although for convenience we often refer to any capital investments in real estate as real estate investments, this concept is divided into two categories: investments in residential and commercial properties.

Residential real estate includes land, buildings, and premises intended for people to live in. This category includes apartments, houses, townhouses, and other types of residential buildings. Additionally, it encompasses common property components such as land and objects on it: trees, water resources, minerals, etc.

Residential real estate is intended for the living of owners or for renting out. The key purpose of such properties is to provide comfortable and safe living conditions. However, their owners or lodgers are not allowed to conduct business on their premises.

Meanwhile, the main purpose of commercial real estate is business operations and entrepreneurial activities. It is often leased to various business ventures and is intended to generate income for its owner.

The primary objects of this category include restaurants, offices, stores, warehouses, hotels, and other premises serving commercial and professional activities.

The main differences between residential and commercial real estate lie in various aspects: purpose, features, operating principles, legal status, and financial investments. Each of these specifics is crucial in the decision-making process of buying, selling, or renting properties from these two categories. So, we will discuss each of them in more detail.

- Purchase Goals

The purpose of buying residential properties is for personal use or long-term rental. Thus, by buying properties in this category, we intend to gain space for our own living or secure a stable income in the form of rent.

Meanwhile, purchasing commercial properties means acquiring a source of passive income and continuous cash flow. By renting out business properties, we provide someone with space for trade, service provision, and business projects, and for ourselves – a steady source of profit.

• Evaluation parameters

When assessing residential real estate, we consider its space and size, as well as the degree of tear and wear. The evaluation of commercial properties requires different criteria. The following criteria are commonly assessed here such as location, the number and density of customer flow, belonging to a particular business niche, as well as prospects for further expansion and development.

Another important evaluation parameter is the cost of the property. Speaking of a residential apartment, its cost will be determined by the average market price per square meter. On the other hand, the valuation of commercial properties is based on the capitalization rate relative to similar objects. In simpler terms, the value of such premises is calculated based on the potential annual profit from its buying at present.

• Legal aspects

Jurisdiction is another crucial point to consider in the detailed study of real estate investments. This is because all activities related to living spaces are regulated by housing legislation, which imposes multiple requirements to ensure adequate conditions for the comfortable living of dwellers.

Thus, residential premises must be isolated and suitable for permanent living. Meanwhile, the main requirements for commercial properties are individual preferences and compliance with conditions allowing their use for stated purposes.

• Cost

Traditionally, the price per square meter of commercial space significantly exceeds the cost of a square meter of a residential apartment. Additionally, the price of two equivalent spaces can differ by 20% or even 30%. Such a situation is determined by the size of the object, its location, renovation, condition, and the quality of infrastructure.

Important factors influencing the cost of commercial properties include the location of the entrance, potential profit from sales or rentals, and the quality of access roads.

• Payback period

Regarding the payback periods for commercial and residential properties, in the first case, it is approximately 7 years, and in the second – 10-15 years. However, if we delve deeper into the rental option, an important psychological factor comes into play. Whereas receiving passive income from renting out a residential property does not require much effort (you simply receive monthly payments from the tenant), the situation with commercial properties is not so straightforward.

Even though this category promises more attractive returns due to high rental prices, its profitability can be a headache for the owner. Here you might unexpectedly encounter many hassles: constant changes of tenants, paperwork, organizational issues requiring prompt solutions, etc. Thus, investments in commercial properties often transform from a source of passive income into a full-fledged business requiring significant time and effort.

• Investment opportunities

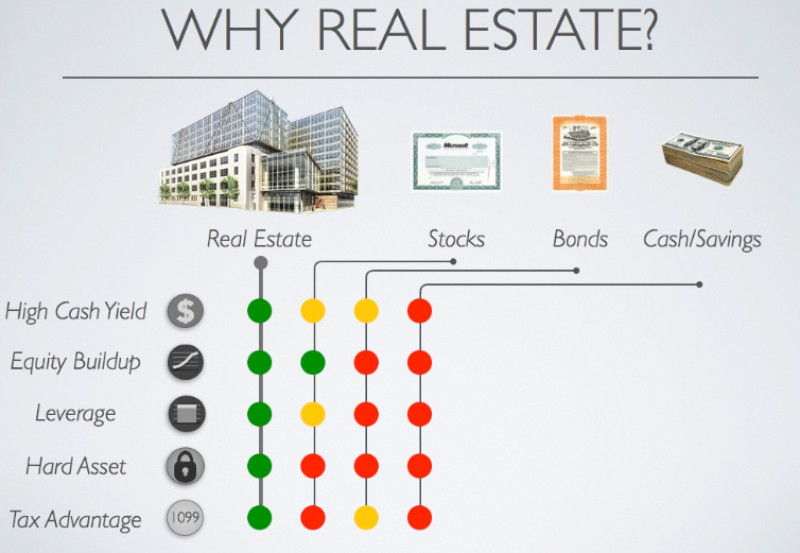

Investments in commercial real estate are traditionally considered more liquid. This is due to constantly rising rental rates and business incomes. However, residential buildings more often provide a stable, albeit lower, long-term income. According to global statistics, the profitability from selling or renting apartments is about 3-5%, while commercial real estate yields is around 6-7%. Interestingly, under some favorable conditions, the latter figure can sometimes reach 10-12%.

We hope that all the above arguments will help you quickly and easily decide on the ideal investment option. However, when deciding whether residential or commercial real estate is better for you, it is also important to be guided by your own goals and financial capabilities. Weigh all the risks, consult with specialists, and thoroughly analyze the current situation in the market you are interested in.

Above all else, ask yourself: what is preferable for me at this particular point in time? If ensuring your own comfortable living or receiving a stable income is your goal, then invest confidently in residential property. If, however, you are looking for high returns, are not afraid of risks, and are ready to cope with various market challenges, then consider commercial properties.

Advantages and disadvantages of real estate investments

Real estate investments have always topped the charts among the most popular capital investment options. No surprise! It is a relatively simple and reliable way to preserve personal savings. Moreover, this sector remains one of the most stable and profitable, even during tumultuous times in global financial markets.

However, is there a guarantee that investing in any real estate property will be profitable? Certainly not. Even in this vast honey pot, there are a few spoons of tar. Let's discuss in more detail the pros and cons of real estate investments.

Advantages:

Guarantee of stability. Demand for residential and commercial properties has always existed and will continue to exist. Moreover, the value of living space rarely decreases, as this sector is the main investment avenue in periods of turbulence and economic upheavals. In relatively quiet times, the housing market fares even better, with banks reducing mortgage interest rates, leading to increased demand and, consequently, prices in the housing market.

Source of passive income. Profit can be earned from the real estate you own. All it takes is finding tenants and setting a favorable monthly rent.

Minimal risks. A property owner can sell or rent their property even during the most acute global crises.

Value appreciation. Real estate prices are not influenced by inflation. Their value only increases over time. Additionally, the constant increase in the cost of building materials acts as a hedge against inflation.

Investment variability. Profit from real estate investments can be achieved through various means: daily rentals, long-term leasing, property flipping, dividing the property into several segments, etc.

Ever-growing potential. Investments in real estate are becoming increasingly popular year after year. A key proof of the constantly increasing profitability of this business sector is that today, commercial real estate investments are chosen not only by individual entrepreneurs but also by many large international companies. Successful business owners are confident that purchasing commercial properties and constructing residential complexes will be ultimately profitable and a gainful investment for them.

Disadvantages:

High start-up capital. Purchasing residential and commercial properties requires a substantial amount at the initial stage. However, some resolve this issue through REIT funds*, which allow capital investment in housing and land without direct purchase. All that is needed is to buy securities of the firm. Undoubtedly, such a purchase is much more affordable than direct property acquisition.

Long payback period. As mentioned earlier, real estate assets do not start generating profit immediately. With commercial properties, income exceeding their cost can be expected no earlier than 7 years, and with residential properties, not before 10 years.

Strategic planning. Despite real estate investment being a relatively simple and reliable way to invest funds, it requires a responsible approach. For example, a spontaneous apartment purchase without subsequent rental can become a passive liability, requiring substantial maintenance expenses.

Additional expenses. Investing in real estate involves paying for utilities, major repairs, and taxes on the transaction amount.

Low liquidity. Buying an apartment, premises, house, or building means these assets can't be quickly converted back into cash. On average, the process of selling residential or business premises takes a month or longer, also entailing additional realtor service costs.

Risks. Real estate investment, like any other, involves numerous risks. An unfortunate location can be one of them. Investors often believe they have chosen an area that will soon be heavily developed, increasing the value of its structures. When this doesn’t happen, the demand for the property falls, along with the owner's potential profit.

Force majeure. No one is immune to unforeseen circumstances. For instance, if the environmental situation near your property suddenly deteriorates, its price and demand will promptly decline.

Dishonest tenants. Oftentimes, instead of peacefully receiving passive income, property owners find themselves demanding monthly payments from tenants, leading to disputes and lawsuits. Unscrupulous tenants can damage furniture and other property, leading to significant restoration costs for the owner.

Depreciation of properties. The value of real estate decreases over time, often due to the construction of a modern building nearby, whose apartments are more attractive to tenants.

Fraud cases. Unfortunately, the real estate market is rife with scams aimed at deceiving and defrauding investors. This includes fly-by-night companies, selling properties with fake documents, and more.

*REIT Fund (Real Estate Investment Trust) is a company that owns and manages profitable real estate. The purchase of properties by such funds is carried out through collective investments of its members.

Conclusion

Investing in residential property or commercial real estate is one of the most popular and promising business directions today. The explanation for this phenomenon is quite straightforward: people will always need comfortable apartments, land to build their dream homes, parking spaces for their cars, and premises for conducting business.

This is why investing in real estate significantly differs from other types of investments. Real estate is a lasting value that is essential to us, regardless of the global economic situation and geopolitical turmoil.

However, one should not be under any illusion. Unfortunately, the value of real estate is not entirely static. To some extent, it depends on the political climate in the world, taxes, inflation, the credit and monetary policies of governments, news background, macroeconomic statistics of countries, as well as wars, pandemics, and climatic catastrophes. But despite this, the real estate market always recovers very quickly from any shocks, and its assets continue to strengthen and grow.

One does not need to be a savvy economic expert or experienced analyst to understand that the demand for residential and commercial real estate will always increase, at least because people constantly need them. This is why investing in real estate remains one of the least risky areas for investment. Moreover, this type of investment will protect you from all the unpleasant nuances associated with investments in other assets.

Even recognizing the instability of today's world, it goes without saying that purchasing real estate ensures confidence in the future as an investor allocates their capital to one of the most reliable sources for preserving savings. And importantly, investing in different categories of real estate will not only allow you to recover its cost but also earn a significant profit in the long term.

You may like:

Back to articles

Back to articles