Embarking on the journey of investing is not limited by age or the amount you start with. Yet, it's crucial to steer clear of treating it as a game of chance like in a casino or lottery – luck shouldn't be the deciding factor. What matters most is a thoughtful approach, grounded in calculation and a comprehensive understanding of market dynamics.

Contrary to the misconception that only those with a background in finance or economics can navigate these waters, anyone can develop the necessary acumen for understanding financial markets.

This article aims to guide you on various paths to learning the art of investment, debunking the myth that formal education is a prerequisite. One of the most accessible avenues explored here is delving into best investments books that cover the intricacies of investing.

You can learn more about various investment strategies, their advantages and disadvantages, and the essential stages that prospective investors should go through in the article Investing for Beginners.

How to learn to invest

Learning to invest is a journey that people approach with varying attitudes. Some skeptics keep their money close, while others rely on the investment choices of friends, family, or acquaintances. The third category comprises those who seek a more informed and deliberate approach, aiming to understand the intricacies of investment and carefully select assets.

The third category is the focus of this article. This group acknowledges that a formal education in economics or finance isn't a universal trait among successful investors. Possessing a university diploma alone doesn't guarantee investment acumen. To become a proficient investor, one needs specific knowledge about financial markets, including understanding what and how much to invest in, setting goals, constructing a portfolio, and more.

This essential knowledge encompasses both theoretical and practical aspects. Aspiring investors have a plethora of options to acquire this knowledge, ranging from free to paid resources. The internet serves as a vast repository of free information, with experienced investors generously sharing insights through courses, articles, blogs, and webinars, providing beginners with fundamental knowledge.

Books, considered a more reliable source, offer not only basics but also in-depth information and investment strategies from reputable investors. For those seeking more advanced education, including personalized training or support, paid courses become a valuable option. Brokerage companies also contribute to the educational landscape by offering courses.

Selecting the right training option involves considering factors such as time, budget, preference for theoretical or practical skills, and other individual preferences. Caution is advised during the selection process, as potential investors may encounter scammers. Vigilance is crucial, especially when faced with promises of unrealistically high returns in a short period. Careful research and discernment can help avoid falling victim to fraudulent schemes and ensure a more fruitful learning experience.

How long does it take to learn investing

Training is a crucial step towards becoming an investor, but another vital question lingers: how much time does the entire process of transitioning into a trader demand?

The notion that mastering any profession and achieving professional status requires 10,000 hours is often cited. When converted into years, this equates to approximately a decade—a substantial timeframe. However, when juxtaposed with the duration of obtaining a higher education, which involves 4-5 years for a bachelor's degree and an additional 1-2 years for a master's degree, the investment of time appears more manageable. It's worth noting that university education predominantly imparts theoretical knowledge.

In contrast, acquiring skill, particularly in the realm of investing, unfolds through active engagement in the field. The initial phase involves establishing a robust theoretical foundation and gaining preliminary practical skills.

According to experts, the learning process itself typically spans around six months. The duration may vary based on the chosen learning method; for instance, independent study through articles or best investments books may extend the timeline.

If a person chooses courses or personal support from an experienced investor, then the training can go faster. Each course is designed for a certain number of hours.

After receiving a theoretical basis, the future investor needs to gain practical skills. Authors and teachers often suggest conducting the first practical classes during training. This is a big plus, since you can seek help from a more experienced investor, get feedback and correct your mistakes.

Cost of Investment Education

As previously highlighted, investment training comes in both free and paid forms, recognizing the diverse financial circumstances of potential learners. Not every aspiring investor is willing to invest in courses or personal guidance, leading many to explore free avenues for knowledge acquisition through websites, webinars, articles, or books on investments. While self-learning is often cost-effective or even free, it demands more time as individuals navigate the learning curve independently.

For a quicker but pricier route, one can opt for purchasing courses offered by various educational institutions and platforms. The cost of these courses varies significantly based on factors such as the duration of training, topics covered, and the provider. Well-established educational platforms, for instance, may charge between $800 and $1000 or more for a 5-6 month course.

For those seeking more budget-friendly options, basic courses or those with a more focused scope covering 1-2 topics can be found at a significantly lower cost, ranging from $50 to $100. This affordability makes such courses appealing and accessible to a broader audience.

Brokerage companies and exchanges also contribute to the educational landscape by providing training. Some offer free training to their clients upon opening a real account, presenting a cost-effective option for those getting started.

Even among authors whose courses are paid, many provide free trial lessons. This serves as a valuable advantage, allowing users to assess the author's presentation style, clarity of explanations, and overall suitability before committing to a paid course.

Books about investing

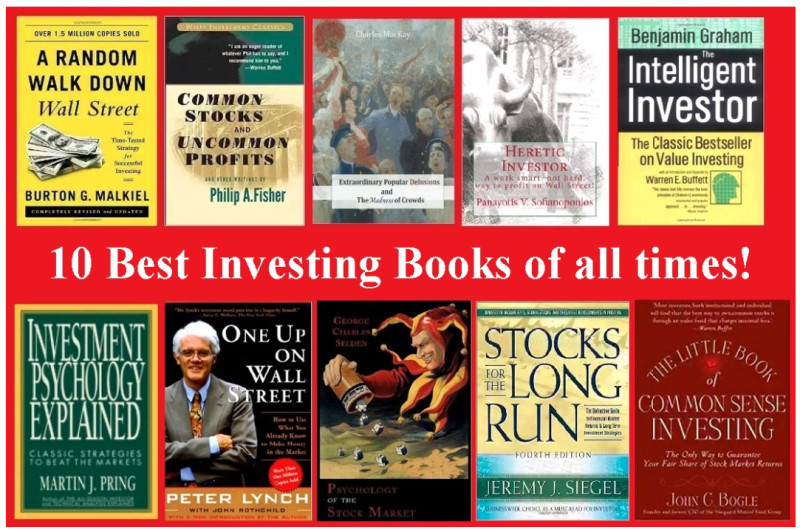

If a potential investor wants to understand a topic and learn all aspects of investing, the best option is to read best investments books about it. We have made a selection of books for you that will be really useful.

At the beginning of his journey of studying the topic, a person needs to become familiar with the most basic concepts from the field of economics and finance, the basics of the activities of exchanges, as well as various investment instruments.

Books are convenient because you can study them at your own pace. Although sometimes a lack of discipline and organization can prevent you from finishing what you started or delay your training for a much longer period than 6 months.

What books are ideal for beginners starting their investment journey? Let's explore a selection of publications authored by notable figures—professors of economics from top universities, accomplished investors, and other renowned individuals.

1. W. Bernstein "The Investor's Manifesto" provides valuable insights for novice investors to skillfully craft an investment portfolio. The book outlines fundamental principles that investors should follow, delivered with a touch of humor, making it an engaging read.

2. B. Malkiel "10 Main Rules for a Beginning Investor" offers succinct guidance in a compact publication. Each rule is dedicated to a specific chapter, enriched with practical examples to enhance comprehension for those just starting out.

3. K. Richards "The Psychology of Investments" delves into a critical aspect influencing investment success—human psychology and emotions. This book imparts the wisdom of making thoughtful decisions without succumbing to fleeting feelings.

4. J. Bogle, in "The Intelligent Investor's Guide," explores the dichotomy between active and passive investing, providing detailed insights into investing in indexes and funds.

5. G. Arnold "Great Investors"is a compilation of biographies and success stories of nine highly renowned and experienced investors. Each investor brings unique approaches to the table, offering beginners exposure to a variety of strategies in a single book.

Best books about investing for experienced investors

Exploring the realm of investing requires a long-term perspective, distinguishing it from the rapid evaluations associated with trading. The true measure of investment success often unfolds over the course of several years, making continuous learning and vigilance imperative for any serious investor.

To maintain a firm grasp on financial portfolios, regular monitoring and adjustments are essential. A monthly review allows investors to assess performance and make necessary tweaks to their portfolios. It's a dynamic process that demands ongoing self-development and a nuanced understanding of market dynamics.

For seasoned investors seeking to deepen their knowledge, here is a selection of insightful publications:

- "The Intelligent Investor" by B. Graham: This bestseller introduces Graham's value investing strategy, emphasizing the psychological aspects, knowledge levels, and experience crucial for investment success.

- "Memoirs of a Stock Speculator" by E. Lefebvre: Although not a textbook, this century-old classic remains relevant, offering valuable insights into the psychology of successful stock speculation.

- "How to Play and Win on the Stock Exchange" by A. Elder: Elder shares his formula for success, highlighting the significance of psychology, analysis, and capital control in the author's perspective.

- "Warren Buffett's Rules for Investing" by J. Miller: This publication features letters from the iconic investor, Warren Buffett, providing a glimpse into his strategies and results, offering valuable lessons for investors.

- "Reasonable Asset Allocation" by W. Bernstein: Tailored for advanced readers, this book delves into numbers and statistics, focusing on the nuanced art of capital distribution among various assets.

Books on stock market analysis

In the process of asset selection for investment, investors predominantly prioritize fundamental analysis. Their emphasis lies in steering clear of momentary fluctuations in asset value, as their primary concern is the long-term potential for price appreciation.

Investors delve into studying the intricate details of a company's financial statements, aiming to decipher its market share, growth prospects, and scalability. Moreover, they recognize the pivotal influence of global dynamics, closely monitoring significant political, economic, and financial developments that could shape market conditions. This holistic approach allows investors to form a comprehensive understanding of an asset's intrinsic value and its viability for sustained long-term growth.

We have curated a concise selection of books on investment that caters to both novices and seasoned investors. Let's delve into these valuable publications.

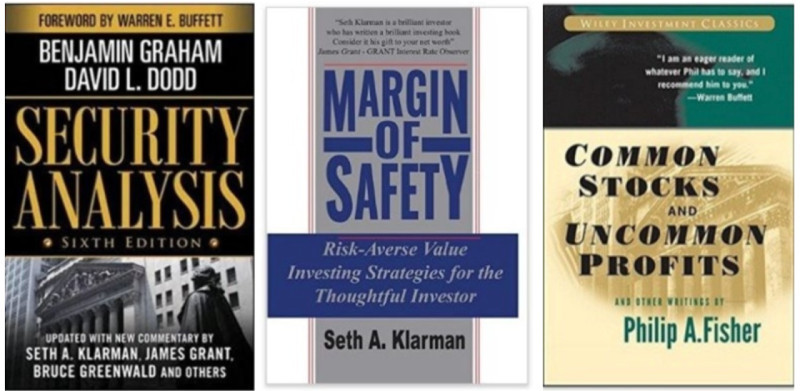

1. "Security Analysis" by B. Graham and D. Dodd: This comprehensive guide meticulously explores all facets of scrutinizing a company's financial statements. Given the intricacies involved, we recommend diving into the material with an actual company report in hand, allowing readers to put their understanding to the test.

2. "Investment Valuation" by A. Damodaran: Noteworthy for its non-linear structure, this publication allows readers to start from any chapter that piques their interest. A. Damodaran's work equips readers with the skills to determine the fair value of stocks, providing valuable insights into investment valuation.

3. "Common Stocks and Uncommon Profits" by Philip Fisher: Focused on the securities of budding, promising companies, Philip Fisher imparts his renowned "rumor method" for identifying such stocks. This best investments books is a valuable resource for those keen on mastering the art of discovering potential gems in the market.

4. "Investment" by W. Sharp, G. Alexander, J. Bailey: Acknowledged as the world's most renowned textbook on investment, this collaborative work covers fundamental aspects of investment education, including comprehensive techniques for asset valuation. Whether you're a beginner or an experienced investor, this book is an indispensable resource.

5. "Secrets of Economic Indicators" by B. Baumol: Shifting the focus to macroeconomic factors and their impact on financial markets, this book by B. Baumol delves into the intricacies of calculating macro indicators and elucidates their direct influence on market dynamics. A valuable resource for those seeking a deeper understanding of the broader economic landscape and its implications for investments.

Pros and cons of investment books

Exploring the merits and drawbacks of learning investment through books reveals a nuanced perspective. Let's delve into the advantages first:

1. Reliable Source: Books, by nature, filter content through a rigorous publishing process, ensuring that only authors with genuine expertise contribute. This quality control ensures a reliable and credible source of information, eliminating the risk of subpar advice.

2. Abundance of Information: Books provide a wealth of information that surpasses the depth and completeness found in many online articles or guides. The comprehensive nature of a book allows for a thorough exploration of investment concepts, making it an invaluable resource for those seeking a deep understanding.

3. Investment Strategies: Authors often share the intricacies of their personal investment strategies in books. This offers novice investors not only foundational knowledge but also actionable insights, providing a valuable roadmap for navigating the complexities of investment.

4. Convenience of Learning: The flexibility of learning from books is a significant advantage. Whether during a break at work or while traveling, readers can absorb knowledge at their own pace, making it a convenient and adaptable way to enhance understanding.

However, it's crucial to acknowledge the limitations:

1. Lack of Practice: Unlike courses that integrate both theoretical and practical lessons, books primarily focus on theoretical knowledge. While the theoretical foundation is essential, practical application is equally crucial for fostering a well-rounded understanding of investment dynamics.

2. Absence of Feedback: Books, unlike courses with interactive components, lack the feedback loop crucial for learning. Assignments presented in books may exist, but the absence of an interactive process with authors or instructors makes it challenging for readers to receive personalized feedback, hindering the learning experience.

Tips for beginners

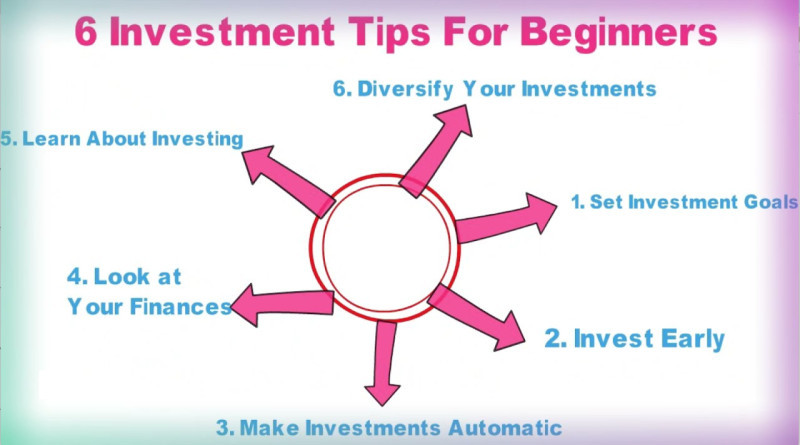

For those still inspired to venture into the realm of investing after absorbing the wealth of information, let's distill key insights into a concise set of rules. Many of these principles can be gleaned from the rich tapestry of investment literature we discussed earlier.

- Learn the art of saving: Beyond funds earmarked for investments, cultivating the discipline to save is paramount. Building a financial safety net ensures not just investment resilience but also the ability to sustain yourself and your family independently for a while, safeguarding your invested capital.

- Invest in knowledge: Mastery of the fundamental laws governing stock markets demands an investment in learning. While not every investor possesses a background in economics, there are accessible avenues, with books serving as a valuable resource to demystify the complexities of investing.

- Define your investment style: Assess the time commitment you're willing to make in the world of investments. Your choice between active and passive investing hinges on this decision. Active investors manage their portfolios hands-on, while passive investors rely on funds or trust management.

- Embrace diversification: Wise investing involves spreading your capital across various assets with different risk-return profiles, spanning diverse sectors and, if feasible, different countries. This strategic diversification mitigates risks associated with concentrating all your investments in a single asset.

- Cultivate emotional resilience: Acknowledge the paramount role of psychology in investing, a recurring theme in the referenced literature. Especially crucial for beginners prone to impulsive decisions, maintaining emotional composure is integral to wise and rational investment choices.

- Commit to continuous learning: The path to investment success involves perpetual self-development. Seasoned investors, as well as newcomers, can glean valuable insights from books, articles, webinars, and advanced courses to stay abreast of evolving market dynamics.

- Monitor your portfolio: While assets accumulate over years, regularly tracking your portfolio allows for timely adjustments. Monthly or quarterly reviews enable the removal of underperforming assets and the inclusion of more promising instruments, ensuring your portfolio aligns with your investment goals.

- As Warren Buffett aptly puts it, "The best time to start investing is yesterday, but you can start today." Initiating your investment journey sooner enhances the potential for greater results, even with a modest starting capital.

Conclusion

This article has delved into a pivotal aspect: the training of novice investors, a process that can take various forms, including internet articles, webinars, courses, and personalized lessons. Among these options, books about investments stand out as one of the most accessible and reliable avenues.

Books serve as not only an accessible but also a trustworthy source of information, housing meticulously verified content. In contrast, internet articles and webinars, often presented by self-proclaimed "experienced and successful investors," may carry an excess of filler and outdated data.

The strength of best investments books lies in their capacity to present information in a comprehensive and detailed manner. Authors, drawing on their expertise, share investment strategies, principles, and rules that prove invaluable for novice investors seeking actionable guidance.

Publications in this domain cater to diverse tastes and reader readiness levels. Beginner-friendly books offer foundational knowledge about financial markets, operational principles, and asset characteristics, presented in clear and accessible language.

For more advanced users, there are books that delve into intricate numbers, statistics, and conduct in-depth analyses. These publications prove relevant for individuals already engaged in investments, aiming to deepen their understanding, acquire new insights, and enhance their strategic approach.

However, the primary drawback of books is the absence of direct author feedback. In the absence of a direct channel for reader-author interaction, questions that arise during the reading process must be resolved independently. Despite this limitation, the wealth of knowledge and insights gained from well-crafted investment books makes them an indispensable resource for aspiring and experienced investors alike.

You may like:

Back to articles

Back to articles