Despite digital currencies emerging over ten years ago, many users remain cautious and do not consider them as an asset that can generate profit.

To dispel these fears, we aim to thoroughly explore this topic and clarify all the main questions related to digital currencies. This issue comes to the fore in the context of widespread digitalization.

Understanding the essence of cryptocurrency will give people confidence. Let’s figure out how and when it appeared, what tokens are available, how they can be used, and how to profit from them. Perhaps, it will open up a new world of digital money for our readers, offering new, unique opportunities.

Cryptocurrency in essence

Cryptocurrency in a nutshell is a digital or virtual asset that lacks a real or physical counterpart. To understand how does cryptocurrency works, let's examine its main characteristics.

Cryptocurrency is digital money that exists only online. It cannot be withdrawn from an account and touched. However, on special platforms, it can be exchanged for other well-known currencies, such as the US dollar or euro, and withdrawn.

Cryptocurrency is gaining increasing popularity and becoming an alternative to traditional monetary units. Predominantly, it is used not for paying for goods and services but for trading or investing with the aim of earning income.

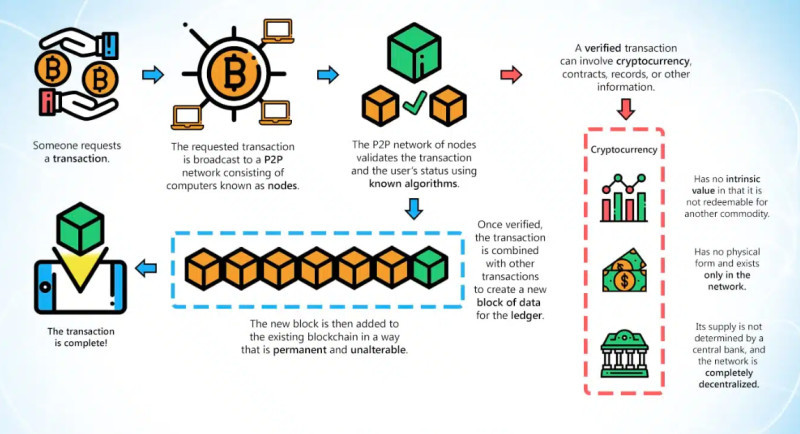

Blockchain technology is used to ensure the security of transactions. This is a chain of blocks, each containing data about transactions. In other words, it's like a ledger that records all information about how much crypto each person possesses.

Another important feature is that the entries in this ledger are protected using a special method of data encryption - cryptography. With this technology, all entries are transformed into secret codes.

When a transfer of crypto from one user to another occurs, a new record is entered into blockchain. However, before this record is added to the ledger, the entire transaction is verified by a network of computers. To keep the system operational, the network solves a large number of complex mathematical problems.

Another participant in this process is miners. They help solve all the tasks in blockchain using special devices and computational power. As a reward for their work, they receive new cryptocurrency.

There is no specific country or government body responsible for issuing crypto or regulating this market. Accordingly, this currency is decentralized. Nonetheless, each country has its own norms and rules regarding the circulation of cryptocurrencies, which are engrained in legislation.

Types of cryptocurrency for beginners

Currently, there are over 20,000 different digital currencies in the world. All cryptocurrencies can be conditionally divided into several main types:

- Bitcoin is in a category of its own as it was the first cryptocurrency to appear in the market. It remains the most well-known and popular digital coin to date.

- Altcoins are currencies that were created after Bitcoin and serve as alternatives. Some of them replicate Bitcoin. In other words, developers use the original code of the first currency to improve and optimize it. Other developers focus on creating new tools.

- Stablecoins are coins whose value is pegged to other financial instruments, such as fiat currencies or precious metals. The most notable example of such a cryptocurrency is Tether, which is pegged to the US dollar (1 USDT = 1 USD);

- Tokens are a separate type of crypto that do not require a new blockchain to be created. They operate and move between users within an already existing network.

There are several significant differences between coins and tokens. The key distinction is that coins require the creation of their own blockchain, whereas tokens operate on blockchains that were created earlier.

Additionally, coins can be used as money, i.e., a means of payment. In contrast, tokens are typically created to solve specific tasks of a particular project.

Apart from supply and demand, the value of a token is also influenced by other factors. For example, many tokens are "pegged" to securities or fiat currencies.

Popular cryptocurrencies for beginners

Nowadays, there is a vast diversity of digital money. Some coins pop up but quickly vanish, while others stay on the market for a longer period. What cryptocurrency is backed by gold? Let's discuss using specific examples.

Some coins are used as universal payment means, while others are developed and used within a specific project. Let's look at a few examples of the most well-known cryptocurrencies.

- Bitcoin (BTC) is the very first and most famous coin. It has shown a tremendous increase in value from a few cents to more than $38,000. There was a time when the price of Bitcoin briefly topped $67,000.

- Ethereum (ETH) is the second most popular coin after Bitcoin running on its own platform launched in 2015. The value of Ethereum is more than $2,000 at the moment.

- Litecoin (LTC) is a "faster" alternative to Bitcoin. It allows for more transactions to be carried out more swiftly. Compared to other coins, Litecoin's value is not high, being just over $70.

- Ripple (XRP) is a coin rolled out in 2012. It can be used to track various transactions. Hence, it is often used by financial firms. Ripple's value is even less than Litecoin's, at only $0.62.

- Tether (USDT) is one of the most well-known stablecoins, whose value is tied to the US dollar. Thus, the value of 1 Tether is almost always equal to $1.

- Dogecoin (DOGE) – a meme coin created for using social media memes. Despite this crypto's high popularity, partly thanks to interest from Elon Musk, its value remains quite low – only $0.081.

Brief history of invention

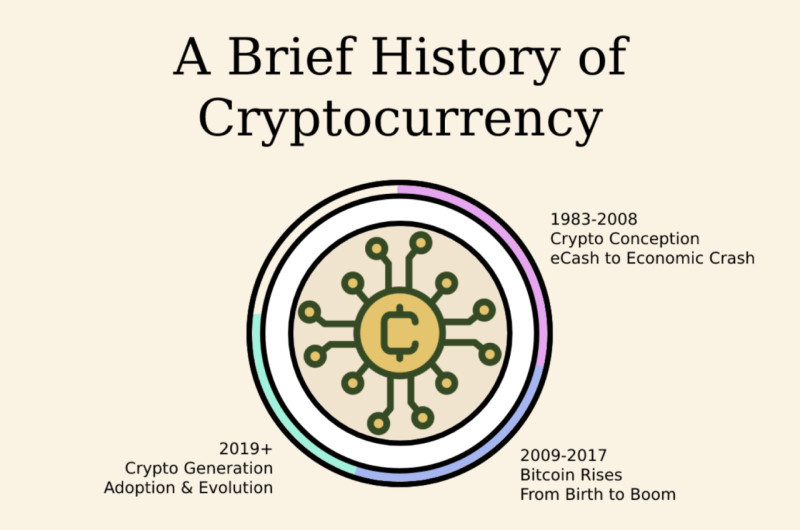

The idea of creating electronic money appeared long before its actual emergence. But when was the first cryptocurrency created and how did it happen? This occurred in the 1980s when two American scientists, D. Chaum and S. Brands, introduced their concept of using digital currency.

Years after this moment, they developed the DigiCash system, which laid the groundwork for using cryptography to ensure the confidentiality of payments. They launched the first electronic money system, eCash, which, unlike modern crypto, was centralized.

However, the experiment failed, and this company ceased to exist. Nearly twenty years after the first attempts to create digital currencies, in 2007, Satoshi Nakamoto began working on creating new electronic money.

He published a paper describing the working principle and protocol of a cryptocurrency that was to operate on a peer-to-peer network basis. Two years later, at the beginning of 2009, the first cryptocurrency – Bitcoin version 0.1 – was released.

Nakamoto created the first block, which included 50 coins, and made the first crypto transfer, equal to 10 bitcoins, to another network participant. From this point on, cryptocurrencies began to develop actively.

In September of the same year, the first exchange of crypto for fiat money was made. In November, the first community of digital currency miners was established. By the end of the year, Bitcoin version 0.2 was designed, and about half a year later – version 0.3.

Gradually, more and more people got involved in creating digital money. At this time, the first mining farm was created, and a few months later – a mining pool.

Upon joining a pool, miners combined their powers and could work faster and mine more coins, with revenue subsequently distributed among all participants.

Cryptocurrency for beginners: then and now

Currently, the value of Bitcoin exceeds $38,000 per coin, but this cryptocurrency has not always held such a high value. When did cryptocurrency start, it was not taken seriously, and its exchange rate to the US dollar was only a few cents.

Originally, mining coins was relatively easy, and miners had large reserves of crypto with nowhere to spend it. There's a famous story where a forum user offered to pay 10,000 Bitcoins to anyone who would order him a pizza.

Another user agreed to this deal, ordered two pizzas for the first user, and in return, received 10,000 Bitcoins in his account. At that time, 10,000 bitcoins were equivalent to $30-$40, but the cryptocurrency quickly began to rally.

A year later, this amount was equivalent to $100,000, and two years later – $9,000,000. Currently, this sum is approximately $380,000,000, making those two pizzas bought for 10,000 Bitcoins the most expensive in the world. There are also stories of buying jeans, t-shirts, and other goods.

Today, the cryptocurrency market continues to grow and develop, with new coins appearing, and their number already exceeds 20,000. Some projects turn out to be more successful, while others quickly disappear from the scene.

However, the fact that digital money is a reality we all have to live and work with is undeniable. This is evidenced by the large number of crypto platforms and exchangers where they can be traded, exchanged for fiat currencies, and used for other transactions. This has morphed into a separate direction in trading and investing.

What can be done with crypto

As mentioned, cryptocurrencies are not tangible objects and exist only in digital space. Nonetheless, as they evolve, they are transforming into real payment means as well as investment instruments.

Let's try to understand in this section how to use cryptocurrency and what it can be used for. So, can you make payments with crypto? Yes, predominantly for making online payments, but still. Moreover, at Starbucks coffee shops, you can also pay with digital currencies.

Another common use is the exchange of electronic money for fiat. Such exchanges are carried out on specialized platforms, after which money in the national currency can be transferred to one's bank account.

Cryptocurrencies are well suited for trading, i.e., short-term speculative transactions on the change in the value of a particular coin. This is due to the high volatility of crypto, i.e., a change in value by several percent even within a single trading day.

Furthermore, digital money is considered an investment instrument, though this mainly applies to the most well-known coins. Although their market quotes may change during the day, they demonstrate stable growth in the long term. Therefore, many investors add them to their investment portfolios.

Another use of cryptocurrencies is for saving. Since this asset is not influenced by the banking system or various processes in the economy, it can be a good means of protection against crises.

How to benefit from crypto

We've already briefly mentioned in the previous chapter that crypto can not only be used for payments but also as a means to earn income. In this section, we will discuss in more detail how to make money on cryptocurrency.

So, to earn income from digital money, there are several most common methods.

- Mining is the extraction of new coins. We've already talked about miners receiving rewards for mining cryptocurrency. Typically, this reward is also expressed in crypto, which can subsequently be used at one's discretion.

- Cloud mining is a type of passive mining where the user simply invests money in a crypto-mining project but does not engage in mining themselves. Necessary equipment is expensive, so miners agree to such deals.

- Trading is making short-term transactions with electronic money. This asset, like no other, is suitable for these purposes, as its value can significantly change within a single trading day. Traders make profits of up to 100% and more on these short-term changes.

- Holding, unlike trading, involves buying digital currencies and holding them until they increase in value. Once the asset reaches the target price mark, the owner sells it. However, it may also happen that the coin does not increase in price.

- Creating your own cryptocurrency. The key here is that the currency represents a certain value: it serves as an access key to some services or represents a financial asset.

- Investing in a crypto fund is similar to trust management. The user invests money in a fund, and the fund selects digital coins to invest in. Subsequently, the profit is distributed among all participants proportionally to their contribution.

- ICO is analogous to IPO in cryptocurrency. When a company wants to release new coins but does not have sufficient funding, it raises funds from investors. However, it's important to understand that the project may not "take off," and earning money from it may not be possible.

Can you earn without investing?

In the previous chapter, we discussed how one can earn income using cryptocurrency. However, what if you do not have initial capital to invest? Let’s explore how to earn from cryptocurrency with minimal investments. In reality, there are several ways available to everyone.

- Affiliate programs. You attract new clients to crypto exchanges. They make transactions and you receive a portion of the commission from each of their transactions. To do this, you need to register with an affiliate program and get an affiliate link to send to your friends and acquaintances.

- Bitcoin Faucets and PTC (Pay-to-Click) websites allow earning rewards for completing simple tasks, such as watching videos, registering, or posting information on forums. However, it's often hard to earn a significant amount this way.

- Creating NFTs is suitable for creative people who can create unique artworks, such as a painting or a song, and then sell them. These can be any objects. The main thing is to obtain a digital certificate of ownership for them.

- Education includes developing guides, courses, webinars, and articles for beginners. However, this way of earning is more suitable for experienced users who have specific knowledge they can share with others.

- AirDrop projects are often related to the launch of new coins. It's a marketing strategy, where a part of the coins is distributed to users for free. In return, users need to perform some simple actions, such as adding the coin to favorites or subscribing to a community.

6. Completing tasks for crypto payments. Platforms launching new features want them tested and ask regular users to perform some simple tasks, for which performers can receive a reward. There are even specialized websites that collect tasks from different platforms.

Cryptocurrency for beginners: buying and storing

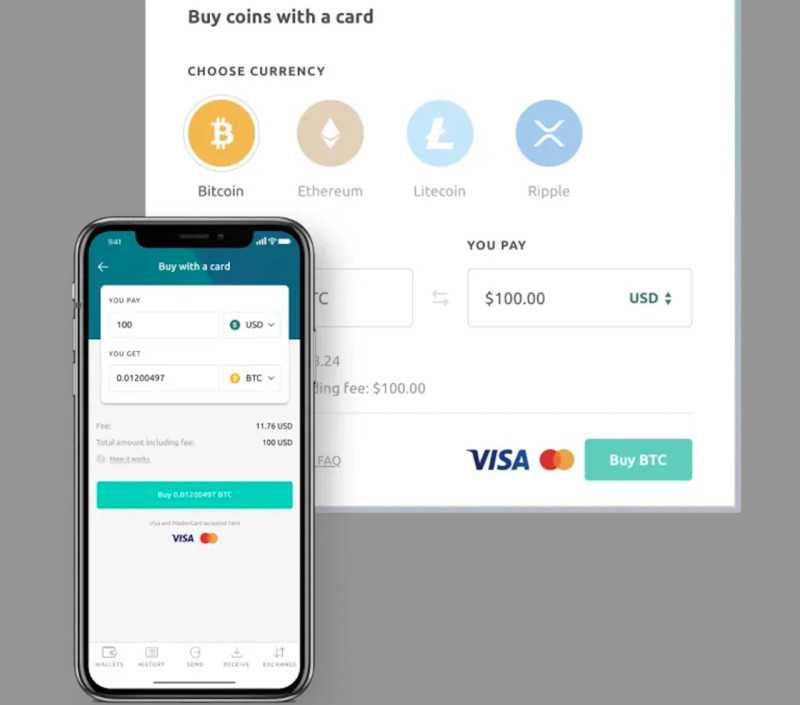

Having explored various ways of acquiring digital money and how to earn cryptocurrency without investments or how to make money on cryptocurrency with minimal investment, let's now look at the mechanism of buying and, more importantly, storing digital currencies. So, where can one buy electronic money? The most reliable option is to conduct all transactions for buying and selling crypto on specialized platforms: crypto exchanges.

When choosing a reliable exchange, please check for the following criteria:

- the exchange's operation period and regulation;

- user reviews;

- whether there is a requirement for client verification.

Additionally, it's advisable to use special crypto browsers with enhanced security, choose reliable passwords, set up two-factor authentication, and take other security measures.

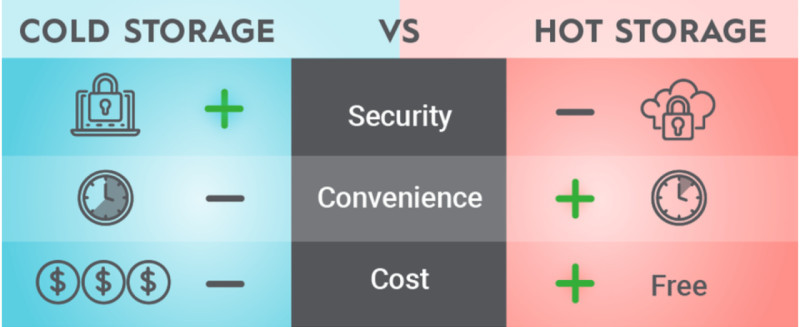

Now that you have acquired digital currency, the next question is: how and where to store it? Crypto is stored in special wallets, which are divided into two large groups:

- Hot wallets are online resources designed for using and storing crypto. They are convenient for carrying out various operations as access to them is directly from a smartphone. On the minus side, they can be stolen or hacked by malicious actors.

- Cold wallets are separate devices, physical carriers similar to a USB stick, which have several levels of protection, including a password and pin code. Their main advantage is that they do not connect to the Internet, making them significantly harder to hack or access remotely.

Each type of wallet has its advantages and disadvantages. The main drawback of an online wallet is its vulnerability. However, it's easier to perform operations with it, and access can be restored by verifying your identity, even if you forget your password.

Regarding separate devices, they are more reliable in terms of storage, but to carry out any operations, you would need to upload them to the exchange. Additionally, if you forget your password or any other level of protection, access to the wallet will be lost forever.

Cryptocurrency for beginners: pros and cons

Like any form of money, digital currencies have both positive and negative aspects. We've already discussed the purpose of what is cryptocurrency used for. Now, let's examine its pros and cons.

Pros of cryptocurrency include:

- Crypto lacks a physical form, eliminating any issuance costs since cryptocurrencies exist only in a digital form. Moreover, they are quite difficult to counterfeit, unlike physical money.

- Decentralization. The issuance and circulation of digital money are not controlled by any single state, government body, or individuals.

- Immunity to inflation. Since banks do not participate in circulation and there's no centralized issuance, the value of digital currencies cannot be crashed by printing a large amount of money. Cryptocurrency is mined using a special algorithm with a set limit on mining.

- Anonymity of transactions. All operations are conducted anonymously, which can provide an additional advantage in countries with strict tax policies.

- Direct global payments. Transactions with digital money do not require intermediaries, such as banks, which charge a commission for each operation.

Cons of digital currencies include:

- Volatility. The value of cryptocurrencies can fluctuate by up to 10% within a single trading day, making it difficult to use them as a primary means of payment and to abandon fiat money.

- Risk of hacking attacks. Coins are usually stored in electronic wallets or on platforms that can be hacked by fraudsters. Despite constant improvements in protective mechanisms, such risks still exist.

- Loss of access to the wallet. It's nearly impossible to recover access if you lose your password or other access to your wallet. Similarly, sending money to the wrong address means those funds cannot be returned.

- Lack of real backing. Unlike real currencies, which are backed by the economy and financial status of the issuing countries, crypto is backed only by user trust in the currencies and blockchain system.

- Legal issues. Cryptocurrency is not recognized at the legislative level in all countries. Digital assets are still banned in many countries. In turn, any transactions are punishable by law. Only a few countries legally allow its use as a means of payment.

Tips for beginners on using crypto

We've already looked at how to buy digital currency and store it, and found out the purposes of cryptocurrency. However, it's also important to know how to use electronic money correctly.

Here are some essential rules to follow, so we've gathered some expert tips on dealing with digital currencies for you.

- Beginners should undergo training before starting to earn from crypto. It's crucial to have a basic understanding of how the market works and functions. Ideally, find a mentor who can guide you through this path and provide necessary tips.

- You've seen that it's possible to earn from cryptocurrencies in various ways. Determine your strategy and stick to it. However, remember to be flexible and make adjustments as necessary.

- Start with small amounts. For example, if you decide to try trading, where risks are quite high, as is the potential profit, don't immediately invest large sums, even if they are available to you. First, test everything with small amounts that you can afford to lose.

- The same rule applies to investing in cryptocurrencies as for all other assets: "Don't put all your eggs in one basket." It's necessary to create a portfolio of crypto assets with different levels of potential profitability and, accordingly, different levels of risk.

- Beginners are advised against participating in ICOs due to the high risks. To invest in a truly worthwhile project, you need to understand the topic well and have enough experience. Many such projects never make it to the exchange, and you'll lose your investment.

- Use reliable, proven exchanges for any crypto operations. Many fraudsters in this field may offer more favorable conditions but ultimately just take your money without giving anything in return.

- For beginners, it's better to trade more popular coins in the top 10. They have the greatest stability and liquidity, making them easy to sell if necessary.

- After acquiring digital money, especially if you plan to hold it rather than actively trade, transfer it to a cold wallet. This is the most reliable and secure way to store coins.

Conclusion

In this article, we explored the fundamental aspects related to digital currencies: what cryptocurrency for beginners suits beginners best, how and when it emerged, the different types available, how they can be utilized, and most importantly, how to earn money with them.

Digital money offers extensive opportunities. Additionally, the issuance and regulation of this market are not managed by any single country or governmental body. It's a decentralized system, but it operates by its own rules and principles.

There are currently over 20,000 cryptocurrencies, although not all of them are widely known. However, there are coins familiar to everyone such as Bitcoin, Ether, and a few others.

There are quite a few ways to earn money from digital currencies, some of which don't even require initial investments. Trading and holding are among the most well-known methods of generating income.

After acquiring crypto, one of the most crucial issues is its storage. Experts advise storing your coins on special separate devices, as they offer the highest level of protection.

Back to articles

Back to articles