Digital money and cryptocurrencies evoke mixed feelings among people. While many are skeptical and distrustful of them, others actively use them for transactions and investment purposes. The fear often stems from a lack of understanding, so in this article, we aim to shed light on some key aspects.

To become comfortable using digital currency, it's essential to understand what it is, how it came about, and what preceded its creation. We will discuss the origins and rationale behind digital money, its advantages over traditional fiat currencies, and what the future holds for cryptocurrency.

For those interested in learning more about the various types of cryptocurrencies, how to use them, and ways to earn income from them, as well as methods for purchasing and storing them, the article "Cryptocurrency for Beginners" is a great resource.

What are digital currencies?

Before diving into what is cryptocurrency used for necessary, let's define what digital money is and explore the idea behind its inception.

It's challenging to find a single definition that clearly describes electronic money, so we'll analyze several.

Traditionally, there are two types of transactions: cash and non-cash. Cash transactions involve the physical transfer of money (notes, coins) to another person or organization. In non-cash transactions, money is transferred from one account to another without physically changing hands.

Electronic money is similar to non-cash transactions but differs in how it is stored: non-cash funds are kept in a bank account, while electronic money is managed by special non-banking organizations and isn't tied to any specific account.

Then, using a bank card or the payer’s personal account, you can pay for goods and services both online and offline. Electronic money is recorded by special non-bank organizations and is not linked to a specific account, as in a bank.

Electronic money is stored in a digital wallet, which can be used for various payments and topped up through special devices or bank accounts. PayPal is one of the most famous payment systems.

There are several types of electronic money:

- Traditional electronic money;

- Central Bank Digital Currencies (CBDCs);

- Cryptocurrencies.

We have already discussed traditional electronic money. CBDCs are electronic versions of national fiat currencies. Cryptocurrencies are digital money without a physical counterpart, existing in a special network called the blockchain.

How did the concept of digital currencies appear?

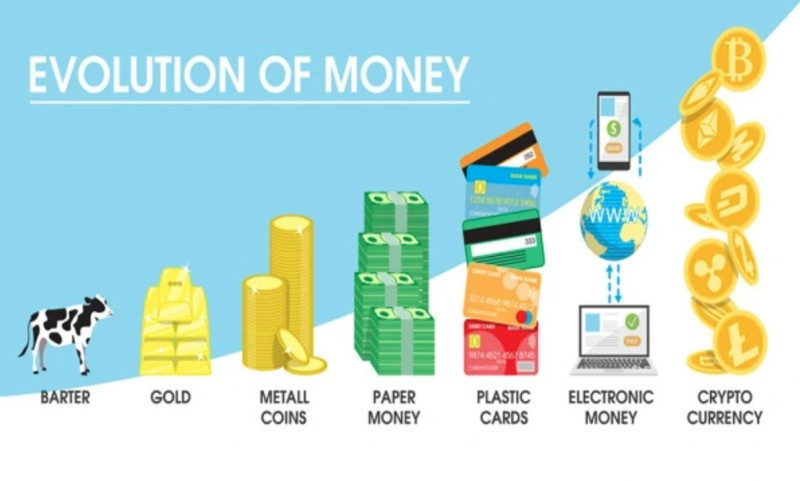

Originally, people exchanged goods and services directly, a system known as barter. However, barter had significant drawbacks: goods could perish, some were hard to transport, and the "exchange rate" constantly changed.

Therefore, gold became a new means of payment. It was valuable to everyone, non-perishable, and easy to transport. However, gold also had disadvantages, such as the costliness of its extraction.

Thus, people moved to paper money, which was easier to produce and store than gold. Paper money had value backed by gold and the trust in the government that issued it. Yet, the issue of security remained, as money could be stolen.

The next stage was the appearance of check books and payments using checks. Each check contained information about the drawer and recipient, their addresses, as well as the signature of the former. At the same time, the big disadvantage of such a system was the time delay: the check was presented to the bank not during the transaction, but after it.

Thus, it was impossible to verify whether the drawer actually had the necessary funds at the time of transfer of the goods. Some unscrupulous users forged signatures and other information on checks without actually having the required amount in the account.

This problem was solved with the advent of cashless payments using bank cards and smartphone apps. Each card has a PIN code that only its owner knows, and bank applications require confirmation of the transaction using a special code or fingerprint/Face ID.

As a result, many existing verification and security problems were resolved. This also made it possible to control cash flows and reduce the amount of “dirty” money obtained through illegal means.

However, all cashless payments are part of the banking system, which has its own shortcomings. During financial crises, banks could fail, and people could lose their savings.

Gradually, trust in banks diminished, and logically, payment systems that were not tied to banks and did not require intermediaries for transactions emerged.

How did cryptocurrency appear?

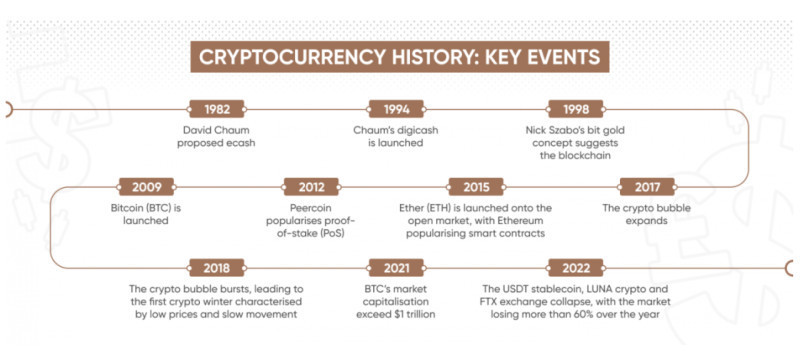

The idea of creating electronic money emerged long before the development of Bitcoin and other digital currencies. Back in the 1980s, D. Chaum proposed the concept of "blind signatures," marking the beginning of the digital money history.

Subsequently, he founded the company "DigiCash," which allowed for anonymous electronic transactions thanks to Chaum's own developments. Already in the 1990s, this company released the first digital currency that was not controlled by the banking system.

To conduct transactions, special software was developed. At the same time, the electronic digital signature was introduced to certify transactions. However, this was not a separate currency; it was assumed that cash would be converted into electronic form.

In 1994, the first purchase over the Internet was made using technology developed by Chaum. Afterwards, a large number of electronic payment systems appeared. However, due to a high number of frauds, many players in this market were forced to leave.

Later, the ideas of digital currencies and decentralized payment systems were repeatedly discussed in various circles, with articles published on the subject. In 2008, someone named Satoshi Nakamoto introduced the concept of a peer-to-peer payment system called Bitcoin.

At the beginning of 2009, the first what is cryptocurrency used for – Bitcoin – appeared, and its first open-source code was released online. Almost immediately, the first transaction transferring Bitcoins from one user to another was conducted.

Currently, there are about 20,000 digital currencies in the world, some of which are well-known, while others are virtually unknown. One thing is clear: cryptocurrencies have firmly entered our lives and show no signs of relinquishing their positions.

Advantages of digital money over fiat currencies

Why are digital currencies gaining more popularity? To understand the purpose of cryptocurrency, it's essential to grasp its key features and advantages over fiat money.

Several characteristics distinguish digital currencies from fiat ones:

- Fiat currencies have a specific issuance center, such as national banks or other financial institutions of countries. In contrast, cryptocurrencies have no central issuing authority where they are centrally produced and controlled;

- Money is subject to inflation, and the more it is printed, the more it loses its real value. Digital currencies are not subject to inflation for several reasons: first, their issuance is programmed and limited; second, the demand for cryptocurrencies is growing while the supply is limited, increasing their value;

- Regarding fiat currencies, there is a constant increase in costs associated with the circulation of cash or transaction costs. As for digital currencies, they are entirely virtual, so there are no costs associated with their circulation, only transaction fees;

- Money does not have the property of belonging to a specific person, and its purchasing properties can be altered by the issuer or even withdrawn from circulation. Digital currencies are tied to a specific account or wallet, so the wallet owner can confirm their ownership.

However, there is a significant drawback to what is cryptocurrency used for that prevents its use as a universal payment method. Its high volatility, meaning significant fluctuations in value over a short period, is a concern.

Fiat currency rates are more stable because they are regulated by the central banks of their countries, and the state acts as their guarantor. Therefore, in the eyes of many people, they appear more reliable than digital currencies, which are backed by nothing but the trust of their users.

Enhanced safety compared to bank cards

One might wonder why use digital currencies when it's currently possible to make cashless payments using bank cards or mobile or internet banking? Nevertheless, making payments with electronic money and wallets where it is stored offers several advantages over conventional bank transfers and payments.

First and foremost is security. Recently, there have been increasing incidents of fraud with bank accounts and cards: criminals try all possible and impossible ways to gain access to information that allows them to access an account and withdraw all the funds.

For instance, phishing is one method, where fraudsters create a website that is visually identical to the original site and send the link to the user. After clicking on such a link and entering their card details on the site, the user gives criminals access to their account. Payment using an electronic wallet differs in that no data is required: neither the card number, its expiry date, nor the secret code. Even if the card is linked to an electronic wallet, the card details are not visible to anyone during payment.

Moreover, electronic wallets can be set up from home, unlike opening a bank account. Opening a wallet is free, and no service charges are incurred during its operation. Often, wallets are protected by entering the user's biometric data (fingerprint or retina scan).

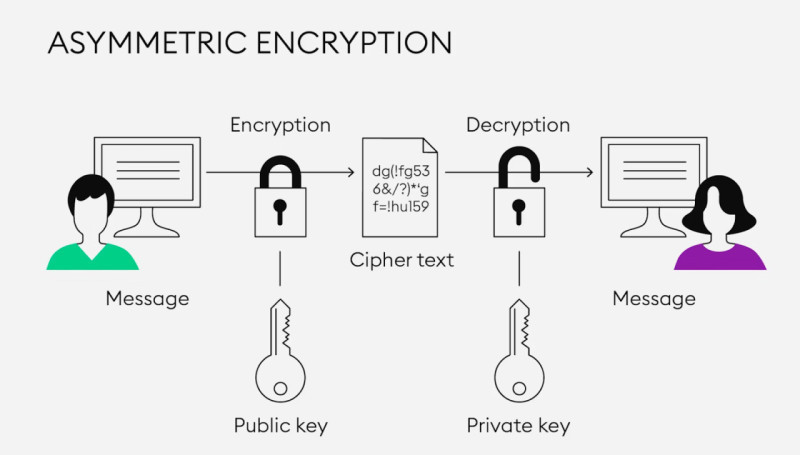

Another important difference in conducting operations with digital currencies is the special way of encrypting data - cryptography. It allows keeping data hidden from other users, and this data can only be decrypted using a special key, which the wallet owner has.

Why cryptocurrency is needed

So, the main advantage of using digital currencies instead of fiat is the high level of transaction security. How is security ensured? The blockchain technology in which cryptocurrencies operate has several levels of protection, let's look at them in more detail.

Firstly, protection is ensured because the records entered in the blockchain cannot be changed. To make any changes even to one record, it's necessary to change not only the entire block of information where these data are stored but also all the blocks in the chain after it.

Secondly, security is provided by a system of distributed ledgers, where information is stored. This means that all data are simultaneously stored on a large number of different servers, which are completely independent of each other and can be located in different parts of the world.

Thirdly, another factor related to distributed ledgers is the consensus protocol. Even if someone manages to make changes to a record on one or several devices, the information on other devices will remain unchanged. The data contained on the majority of devices are recognized as valid.

Finally, a special data encryption technology - cryptography - is used in the blockchain. There are two keys: public and private. The first is used for encoding data and is open, while the second is a secret key, with which information can be decoded.

Moreover, asymmetric encryption is used in the blockchain system. This means that one key is used for encoding information, and another for decoding, which additionally ensures security.

Besides security issues, transactions with cryptocurrencies have other positive aspects, such as the speed and simplicity of making payments, the absence of intermediaries, the ability to make international transfers, and the anonymity of payments.

Why crypto is not used universally

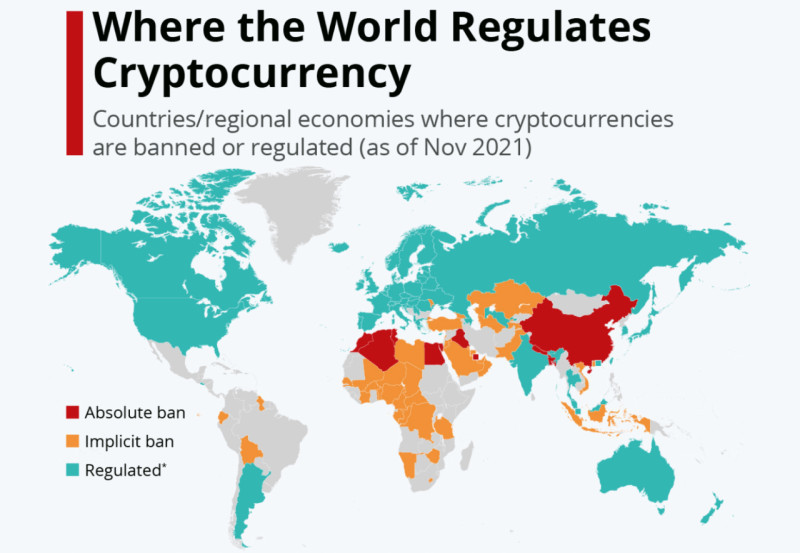

One of the reasons why digital currencies have not yet become a universal payment method is their legal status. In discussing the purpose of cryptocurrency, we cannot ignore this topic, so let's delve into this issue.

Different countries have varying legislation regarding cryptocurrency. In some states, operations with it are permitted. These countries include El Salvador, Japan, the USA, Australia, Canada, France, Russia, Belarus, and a few others. In these countries, special laws have been enacted to regulate the circulation of cryptocurrency.

However, there are also countries where digital currencies and any operations with them are prohibited. These are mainly Eastern and African countries, such as Qatar, Iraq, Morocco, China, Tunisia, Ghana, Algeria, Nepal, and others.

In some countries, there is no complete ban, but certain operations, such as mining, are prohibited, although buying and selling cryptocurrency is allowed. This is the case in Kazakhstan, Indonesia, Turkey, Israel, Thailand, and some other countries.

There are several main reasons why digital currencies are fully or partially banned in some countries. Among them are the desire to control financial flows within the state, protect the national currency, prevent money laundering and the financing of terrorism, among others.

Moreover, the prohibition on conducting transactions with what is cryptocurrency used for is one way to protect investors and the banking system. This is due to the high volatility of digital currencies and the instability of this market, creating high risks.

Nonetheless, many countries are witnessing a relaxation of bans and searching for ways to legalize Bitcoin and other coins. Such a process begins with the development of appropriate legislation and defining the legal status of cryptocurrency, as well as possibilities for its use as a means of payment.

The future of cryptocurrency

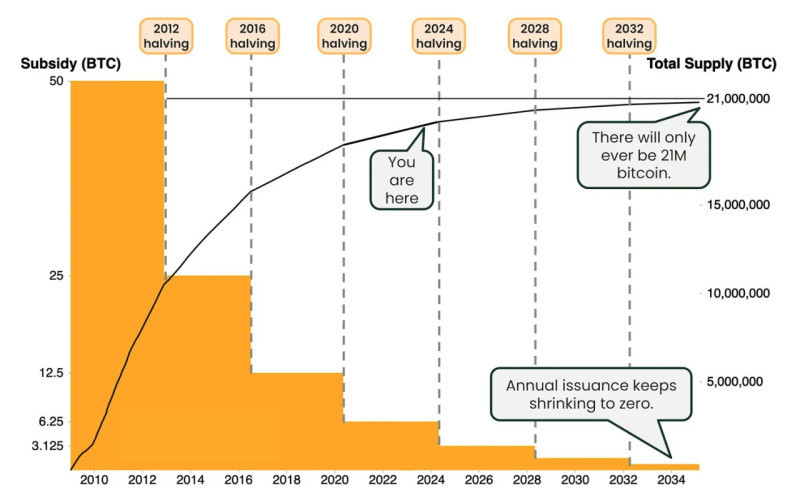

We have already mentioned that the issuance of cryptocurrencies is limited; for instance, the originally programmed quantity of Bitcoin is 21 million. It should be noted that, as of now, over 90% of Bitcoins have already been mined.

What happens next when their issuance ceases? Will the vast number of miners, currently engaged in mining new coins, lose their source of income? Experts believe this will not happen for several reasons.

The mining of digital coins is indeed limited, and the miners' reward for each new block added to the network gradually decreases. This process is known as halving, which occurs every four years, resulting in the reward for a new block being cut in half. Alongside this, there is another process - the increase in the number of transactions with crypto, and consequently, the increase in fees for these operations. Accordingly, as digital currencies become more widespread and their popularity increases, additional fees may arise, for example, for accelerating operations.

Furthermore, further growth in the value of cryptocurrencies, particularly Bitcoin, is expected. It is predicted that the coin may reach the $1 million mark in about 10 years. Therefore, many experts consider it wise to invest in it now. Among the main reasons for such a powerful increase in value is the limited supply. In addition, experts believe that soon many states will see the advantages of digital currencies for their economy and legalize them for payments and savings.

Thanks to decentralization, digital currencies are more flexible and can respond more quickly than the banking system to the challenges of the modern world and adapt to new conditions. One of the main advantages is direct international transfers, which are much simpler and faster than through banks.

Conclusion

In this article, we have tried to understand how electronic money and, following it, digital currencies appeared, what the purpose of what is cryptocurrency used for, what advantages it has over fiat money, and what future awaits it.

Digital coins have several undeniable advantages over fiat, the main ones being: the absence of a single issuance center, immunity to inflation, no intermediaries, and lower transaction costs.

Thus, crypto can be used for direct international transfers. In addition, digital coins circulate in a special system - the blockchain, which has several levels of protection. Therefore, making payments and transfers in this network is considered one of the safest.

Despite this, digital currencies are still not recognized at the state level in many countries. Only a few countries allow using crypto as a payment method or investment asset.

One of the reasons digital currencies cannot act as a universal payment method is their high volatility. Their rates can change by tens of percent in a single day, whereas fiat money rates are regulated by central banks and are therefore more stable.

Nevertheless, experts believe that the legalization of cryptocurrencies in more countries will continue in the future. This process has already begun, as governments start to realize the benefits of integrating crypto into their economy.

The demand for digital currencies continues to grow, while the supply is limited, as the number of coins that can be issued into circulation is programmed. Due to this, the popularity and value of crypto are increasing. Many people already consider it as an investment tool, and interest in it is only growing.

Another promising direction for the development of electronic money is the emergence of Central Bank Digital Currencies (CBDCs). Such projects are already being developed and tested in several countries. However, unlike cryptocurrencies, CBDCs will be issued and controlled by central banks.

You may also like:

What Cryptocurrency is Backed by Gold

When was the First Cryptocurrency Created

How to Make Money on Cryptocurrency

Back to articles

Back to articles