Avalanche is a next-generation project designed to address blockchain scalability and security issues. The primary token in the Avalanche network is AVAX, which plays a crucial role in the project’s ecosystem. The Avalanche blockchain is an advanced ecosystem characterized by high-speed information transfer, instant transaction processing, and flexible scalability.

The creators of this network aimed to invent the most efficient and secure virtual environment for developing decentralized applications and customizing individual blockchain networks.

In this article, we will look at the Avalanche project, its native token AVAX, and its prospects.

What is Avalanche?

The platform itself is an environment for creating and launching decentralized applications (DeFi) and conducting financial transactions, trading, and more. The designers of Avalanche aim to transform their project into a global network for exchanging virtual assets, allowing anyone to develop and trade on its basis while managing assets in a decentralized manner through smart contracts or other modern technologies.

The Ava Labs team stated that even the basic version of the Avalanche network is capable of processing transactions almost instantly, in less than 1 second. The new network was launched in September 2020, along with its native token, AVAX. This token was created as a means to regulate the new blockchain, serve as a reward system, and act as a payment method for users.

Avalanche is an open-source platform designed for launching decentralized applications and developing public and private networks in a unified, scalable system.

Unique features of Avalanche

Avalanche uses a consensus protocol based on Directed Acyclic Graph (DAG). This approach is significantly different from standard proof-of-work (PoW) and proof-of-stake (PoS) protocols, allowing the network to reach consensus among nodes quickly and efficiently even under heavy loads. The DAG structure of the network helps eliminate centralization issues and ensures reliable and secure cryptocurrency operations. Avalanche represents a progressive technology that can change perceptions of blockchain consensus.

Avalanche structure

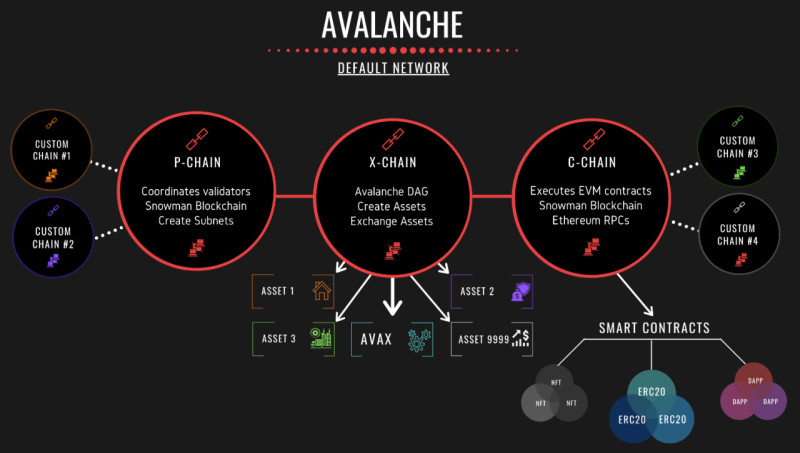

The structure of Avalanche is built as follows:

- Primary Network

- Subnets

The Primary Network consists of three blockchains:

- A platform Chain (P-Chain) is used for storing metadata, coordinating validators, and tracking subnets.

- A contract Chain (C-Chain) is used for developing Ethereum-compatible smart contracts.

- Exchange Chain (X-Chain) is used for exchanging information between subnets and for developing both fungible and non-fungible tokens (NFTs).

Subnets in Avalanche

Avalanche subnets are similar to layer 2 networks (L2 solutions) for Ethereum and parachains in Polkadot. However, unlike them, Avalanche subnets are completely isolated from each other. Virtually any participant in the Avalanche network can create their own subnet for a small fee of 0.01 AVAX.

All Avalanche nodes must validate transactions on the primary network, but validation in other subnets is optional. Creators of new subnets can add various parameters, including launching multiple blockchains and setting their own validator requirements, such as mandatory KYC/AML compliance.

History of Avalanche project and AVAX token

The cryptocurrency startup Ava Labs was launched as a new project in 2018, with the idea conceived by experienced developers and cryptographers Emin Gün Sirer and Kevin Sekniqi. They aimed to create a new platform capable of providing significantly higher transaction speeds and enhanced security.

In 2020, the Ava Labs development team created and launched the Avalanche blockchain, initially operating in test mode. This new network quickly attracted the attention of many large investors interested in the crypto industry. As a result, the project raised over $300 million from interested investors at its inception. This funding was sufficient to conduct a successful token sale, starting with a public sale followed by a private sale.

The public sale was highly successful, with 72 million tokens sold in just four hours, raising $42 million. The private sale was even more successful and profitable, bringing in an impressive $242 million for the startup.

Following such investments, the Ava Labs team had no choice but to launch the main network—Avalanche mainnet. At its launch, this new blockchain was capable of processing an enormous number of transactions—4,500 per second.

In the fall of 2020, a new virtual asset—AVAX cryptocurrency, the native token of the new network—was rolled out. Around the same period, the token was listed on the largest cryptocurrency exchange, Binance. The popular platform added AVAX to trading pairs with the most demanded stablecoins, as well as AVAX/BTC and AVAX/BNB. Subsequently, Binance introduced margin trading and derivatives for AVAX. Today, AVAX is available on almost all major crypto exchanges.

Notably, the AVAX cryptocurrency was developed by the Ava Labs team as a main competitor to Ethereum. Likely due to such bold claims by the token’s creators, its value skyrocketed by a whopping 650% after the listing.

It’s evident that funding from major companies like the largest Chinese mining equipment manufacturer Bitmain, South Korean company Galaxy, and San Francisco-based venture company Polychain contributed to the project's successful start.

Today, the Avalanche blockchain continues to develop with all its additions and constant updates, extending into the future.

Avalanche consensus protocols

The Avalanche blockchain platform is unique because it operates on an entire system of consensus protocols called Snow. This system combines three consensus mechanisms:

- Avalanche

- Snowman

- Frosty

The Snowman mechanism is implemented in the P-Chain and C-Chain networks, while the Avalanche mechanism is realized in the X-Chain network. The Frosty consensus mechanism is still being developed, so we won’t discuss it here.

Thanks to the Avalanche mechanism, operations in the network can be processed synchronously (simultaneously). To verify the validity of a transaction, validators send requests to each other randomly, without any specific order.

The Avalanche mechanism stands out among others because it does not have blocks; instead, the protocol regulates parent transactions, also called vertices. These vertices allow validators to group transactions for voting. In this case, the transaction verification process does not happen instantly but gradually over time.

The Snowman mechanism arranges operations in a linear order. Unlike Avalanche, it forms blocks rather than vertices. This principle facilitates working with smart contracts and significantly increases the overall blockchain throughput.

How Avalanche protocol works

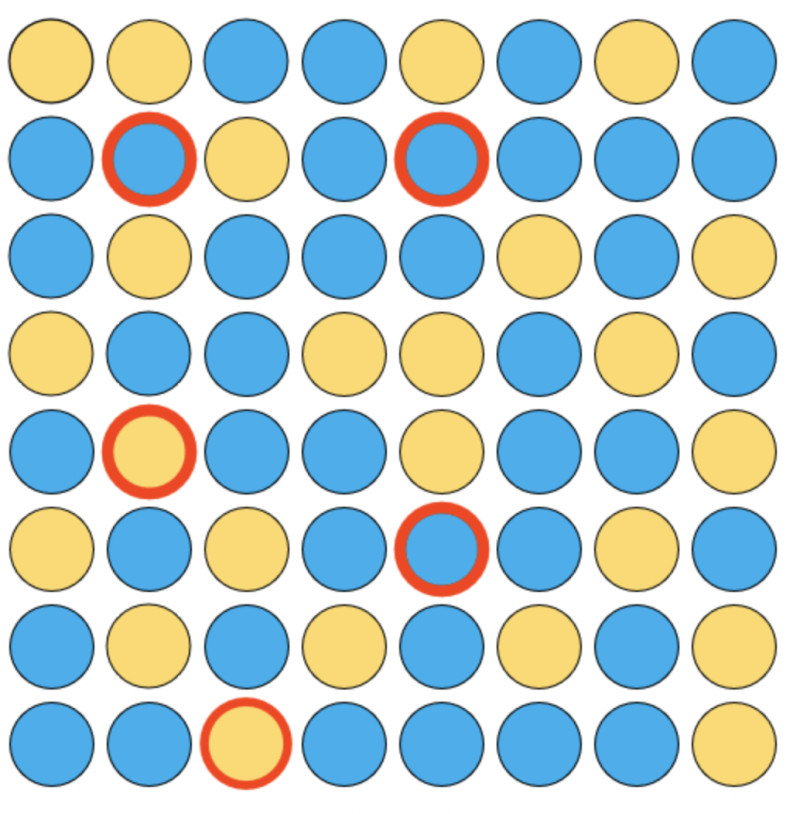

The process of approving and rejecting transactions in the Avalanche protocol can be illustrated with a simple example—how network nodes choose between yellow or blue colors.

Nodes choose a color and then query other nodes about their choice. If a node's chosen color does not match the majority choice, it must change its decision.

For example, a node chooses yellow and then sends requests to five nodes (depicted in red circles). If the majority of these five nodes chose blue instead of yellow, the sender must change its choice to blue.

This process occurs step-by-step, round after round, until all nodes reach a consensus and have the same color.

Importantly, the time to receive responses is not infinite but strictly limited, ensuring no delays caused by slow nodes.

The network randomly determines the necessary nodes, with the probability of participating in transaction verification increasing with the number of Avalanche coins staked.

Advantages and disadvantages of Avalanche network

The Avalanche platform is not a perfect solution; alongside its obvious advantages, it also has several disadvantages. But let’s start with what attracts users to this network:

Advantages:

- Speed of transactions. Avalanche’s main feature is the near-instantaneous processing of transactions. It is well-known that the speed of transactions is crucial for the network’s scalability and the convenience and comfort of users.

- Incentive-based rewards. The platform provides rewards structured around incentives. The more active a client is on the platform, the higher their chances of receiving a reward.

- Support for multiple blockchain-based projects. This means that the Avalanche network can easily host various blockchain-based projects, including DeFi, NFTs, and more.

Disadvantages:

- Increasing competition. While Avalanche continuously innovates and integrates new features for its clients, it struggles to compete with popular and successful platforms like Ethereum. Ethereum has a much larger client base and a stronger, larger development team compared to Avalanche.

- High validator entry requirements. To become a validator on the Avalanche blockchain, one needs to have 2000 AVAX coins. This is considered a very high entry barrier, meaning not everyone can become a validator. This situation risks somewhat centralizing the validation process.

- Lack of penalties for malicious validators. The absence of penalties for validators who engage in malicious activities poses a risk to the security and integrity of the entire system.

Despite these drawbacks, the Avalanche platform continues to evolve actively, likely addressing current issues over time. For instance, it may lower the high entry requirements for validators and introduce penalty systems for malicious validators in the future.

In its attempt to outpace its main competitor, Ethereum, the Avalanche project strives for continuous improvement, seeking partnerships with other platforms and integrating various projects into its structure. Clearly, this ambition will help expand the usage options for its blockchain.

Features of AVAX token

The AVAX cryptocurrency is the native token of the Avalanche blockchain platform and the official medium of exchange within its ecosystem. The token also enables trading within the network and participation in staking.

The total supply of AVAX tokens is limited, preventing potential inflation. Initially, AVAX units were issued during the initial coin offering (ICO), with the remainder distributed as rewards among staking participants. This approach aims to incentivize clients to continue using the ecosystem and ensure the network’s security.

The Avalanche blockchain ecosystem includes a mechanism whereby all AVAX tokens received as transaction fees are burned. Validator rewards are possible only through the creation of new blocks. Burning transaction fees gradually reduces the total supply of AVAX tokens. If demand remains high, the token’s value will increase.

The Avalanche team released a total of 720 million coins, with 270 million (38% of the initial supply) currently circulating in the market. At the project’s inception, 360 million tokens were minted and distributed as follows:

- 20% allocated to project leaders (used for marketing and further development)

- 15% given to team members and key partners

- 16% sold to investors during public and private sales

The remaining 360 million cryptocurrency units are intended as rewards for creating new blocks (i.e., for staking).

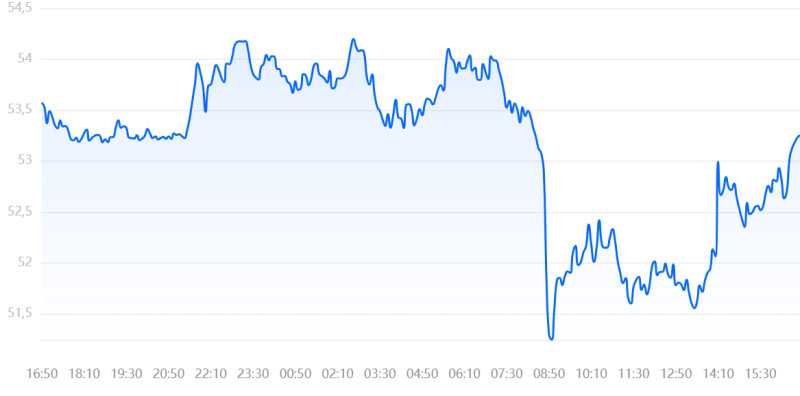

As of the time of writing, the AVAX cryptocurrency is trading at $53.26. The market capitalization of the coin is $19,726,212,879.

AVAX market dynamics

The AVAX cryptocurrency first appeared on exchanges in September 2020. Initially, the asset was priced at around $4 per unit. Avalanche cryptocurrency received a strong welcome from market players right from the start, and even at its launch, its price never dropped below $2.8.

The first price surge occurred six months after the mainnet launch, when the token reached $40, ten times its initial value. This jump in price happened for several reasons:

- Listing on OKCoin and KuCoin exchanges;

- The release of the algorithmic stablecoin FRAX and the Avalanche Club accelerator;

- A hard fork that involved burning 50% of all transaction fees within the network.

All subsequent listings, releases, and updates demonstrated the viability of this project, with the AVAX price surpassing $140 just a year after its launch. Later, the price started to decline gradually, following the bearish trend in the crypto market.

Factors Influencing AVAX fluctuations

The price of the AVAX token can change due to several factors:

- Overall market sentiment.

- The success of the Avalanche project within the crypto industry.

Since AVAX is backed by a technically sound product, the Avalanche blockchain, it is evident that all its successes will positively influence the token’s price. For example, in August 2021, the Avalanche team announced its first major event, a $180 million liquidity mining incentive program. This program was conducted in collaboration with well-known decentralized platforms Curve and AAVE to attract as many similar platforms to the new network as possible. This news immediately triggered a sharp increase in AVAX’s price.

Another example is the creation of a new bridge between the Ethereum and Avalanche networks during the same period. Within just three weeks of its launch, over $100 million worth of tokens were transferred between these two networks. Clearly, token holders seek environments with the lowest transaction fees. This news also significantly boosted the AVAX price at that time.

Where to buy and how to store AVAX tokens

Today, there are many ways to acquire AVAX tokens, borrow them from an exchange (i.e., margin trading), or purchase derivatives.

Methods to buy AVAX:

- Centralized exchanges: Create an authorized account and deposit funds (e.g., Binance, OKX);

- Decentralized exchanges: No verified account needed (e.g., SushiSwap, PancakeSwap);

- Various exchangers (websites);

- Services for buying tokens with fiat currency from individuals.

The safest way of buying cryptocurrency is major popular exchanges. For large amounts, it is best to withdraw the cryptocurrency from the exchange to a hardware wallet (e.g., Ledger or Trezor).

Storing AVAX tokens

It is best to store a large number of AVAX tokens on hardware wallets, though there are only a few reliable ones. Some options include:

- Avalanche wallet

- MetaMask

- Coin98 wallet

Avalanche’s prospects

The Avalanche network and AVAX cryptocurrency can be considered promising projects, especially in terms of their long-term development. Here are a few factors confirming this:

- Integration with popular decentralized applications (DApps). The Avalanche blockchain is more user-friendly than Ethereum’s, attracting DApp users. This results in the transfer of assets from Ethereum to Avalanche, encouraging the project’s development and increasing the value of its native token.

- Burning AVAX tokens. The blockchain developers have stated that all fees received in AVAX for network operations will be burned. This gradually reduces the total supply of tokens, thereby increasing their value. However, the burning process is slow, so its impact will be more noticeable over time. To date, 2 million tokens have been burned (0.27% of the initial supply of 720 million). This is quite a significant result.

- Unique consensus approach. Avalanche’s network provides a high transaction speed and promises new scaling opportunities while maintaining high security and decentralization.

- Creating subnets with special rules. This principle offers developers the flexibility to create new projects in various fields (from financial services to social media development).

- Burning a portion of transaction fees. This reduces the overall supply of tokens, leading to a long-term price increase.

- Active community and partnerships. An engaged community should lead to the ecosystem's growth and strengthen its position in the crypto world.

- Focus on decentralized platforms and NFTs. This focus aligns with current trends in the blockchain industry.

- Continuous improvement of core scaling features. All these factors undoubtedly point to the further development of the entire Avalanche system, which is already one of the most powerful blockchain platforms today.

Thanks to its innovative technologies and unique solutions, Avalanche has become a leader in blockchain development and continues to attract new users and investors. Today, Avalanche and AVAX continue to develop and improve, opening new opportunities for users and providing a reliable and secure infrastructure for working with cryptocurrencies.

Back to articles

Back to articles