The Euro currency behaves differently in pairs with other currencies – it stagnates when paired with the US dollar, waiting for the next information driver, while it trades in a flat, in a narrow range, when paired with the franc. If we talk about the EUR/GBP cross-pair, it shows here that buyers and sellers alternately counterattack, provoking volatility. It is only when paired with the Japanese yen, the euro feels like a clear favorite.

The EUR/JPY pair has surged by almost 400 points since January 31, reflecting the strong position of the euro. In this case, the "stars aligned" in favor of the upward trend: the "dovish" rhetoric of the representatives of the Bank of Japan was layered on the "hawkish hints" of the European Central Bank. And although this EUR/JPY growth structure looks quite fragile (ECB members may take a rather cautious position at the March meeting), the euro is currently in higher demand.

It can be recalled that after the results of the last ECB meeting, Christine Lagarde did not repeat the phrase that "the regulator will not raise the interest rate in 2022." She avoided specifics in every possible way on this issue, stating in the end that much will depend on the March revision of the Central Bank's macroeconomic forecasts. Such rhetoric of the ECB President was interpreted in favor of the euro. Many experts suggested that the "recalibration" of monetary policy could be publicly announced at the March meeting.

Given this, the euro has strengthened its position throughout the market, including the US dollar. But if the US dollar recovers some of the lost positions over time (primarily due to hawkish expectations regarding the Fed's further steps), then the yen does not have such significant allies. The Bank of Japan is still implementing an accommodation policy, and so far is not going to follow the hawkish example of its colleagues. Most experts said that the Japanese regulator will remain one of the most dovish central banks in the near future.

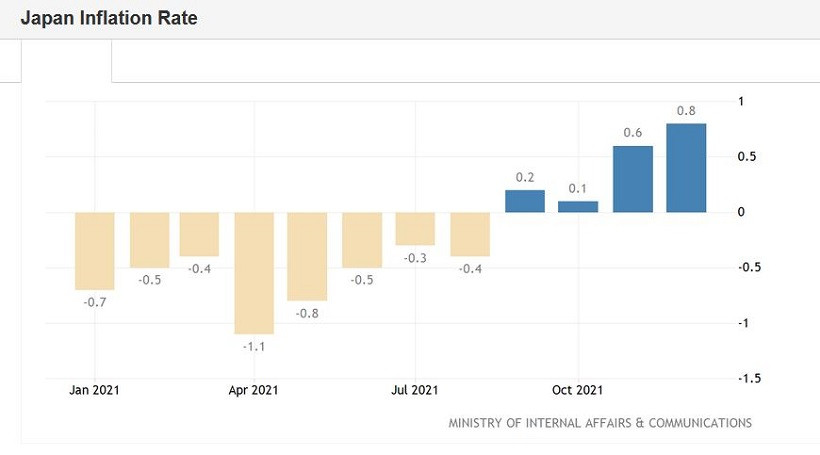

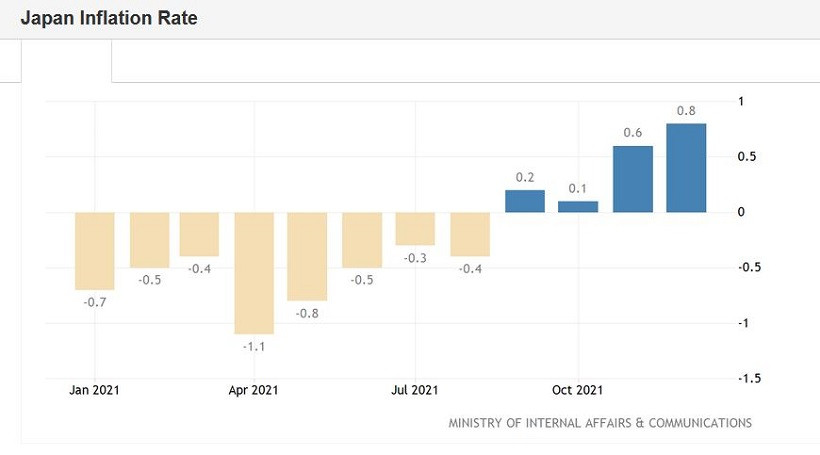

It is noteworthy that the Bank of Japan maintains a cautious stance although the overall inflation in the country is showing positive dynamics and even updating multi-month records. For example, the December consumer price index came out in the "green zone", reaching 0.8%. The indicator is above zero for the fourth month in a row, and the growth rate of the general CPI is the highest since 2019. Consumer prices excluding fresh food (which the Bank of Japan monitors most closely) increased by 0.5%, the same as in November. However, the inflation index, excluding food and energy prices, was in the "red zone" again, dropping to -0.7% against the forecast of 0.4%.

BoJ's head calmly reacted to inflationary growth. Just today, Haruhiko Kuroda said that the likelihood of a sharp acceleration in consumer inflation in the country is "very, very small." In general, the majority of Bank of Japan officials believe that the inflation growth is temporary, and is due to rising energy and commodity prices. In addition, Kuroda said that inflation in Japan is "much weaker than in Europe and the US", and this fact will not allow the Bank of Japan to follow the example of its counterparts from the UK, New Zealand, or the States, especially amid weak wage growth.

In one of his recent speeches, Kuroda noted that the Central Bank of Japan should continue to implement an extremely accommodative monetary policy for the time being unlike the central banks of the United States and the European Union. The Japanese Central Bank will not tighten measures and will maintain massive stimulus measures. Some analysts believe that the BoJ will remain "on standby" until at least spring 2023. That will be April next year when Kuroda must leave the post of head of the Bank of Japan. Today, he voiced an interesting phrase in this context: "it is early and inappropriate to discuss the curtailment of the soft policy during my remaining term as head of the Bank of Japan."

Meanwhile, ECB representatives continue to fuel the hawkish mood of traders. Yesterday, a member of the Executive Board of the European Central Bank, Isabel Schnabel, said that the regulator "may have to" respond to rising inflation in the eurozone. Bundesbank's President Joachim Nagel also admitted that he would lobby for the normalization of monetary policy if inflation does not slow down by March. At the same time, he did not rule out that the rate could be raised within the current year. According to currency strategists at Wells Fargo & Company, the European regulator will raise the rate by 25 basis points in December, after the completion of bond purchases. However, this scenario may not be implemented if EU inflation shows a downward trend during the year.

At the moment, the euro has the advantage. Hawkish expectations about the ECB's actions and opposite expectations about the Bank of Japan's actions are doing their job. The EUR/JPY cross-pair is growing impulsively, breaking all resistance levels on its way. Therefore, it is advisable to use any more or less large-scale price pullbacks at the moment as an excuse to open longs.

Technically, the pair on the daily chart of the pair is above the Kumo cloud of the Ichimoku indicator and all its lines. The bullish signal "Parade of Lines" indicates the potential for further price growth. In addition, the pair is located between the middle and upper lines of the Bollinger Bands indicator. This also indicates the bullish mood of traders. The level of 132.60 can be considered as the nearest target of the upward movement – this is the resistance level corresponding to the upper line of the Bollinger Bands indicator on the same timeframe.